“Give a man secure possession of a bleak rock, and he will turn it into a garden; give him nine years’ lease of a garden, and he will convert it into a desert."

– Arthur Young

Unfortunately for the English agriculturalist, real estate investment trusts (REITs) hadn’t been introduced to the world during his time. Had Young been familiar with how REITs function, he may have thought twice about how a leased property may prosper over an owned one. Instead of planting the seeds, tending to the crops, and harvesting your bounty on your own time, this is all managed by the trust itself.

So, how do these businesses function? How do they generate revenue? Why are they needed in the first place? And, most importantly for you, what are the benefits and drawbacks of introducing REITs to your investment portfolio?

What Is a REIT?

As an internationally recognized investment vehicle, REITs are essentially companies that own, operate, or finance income-producing real estate or other real assets. If you’ve been to a shopping mall, a grocery store, an apartment building, or even a big box store, it’s typically owned by a REIT and not by the business being run within it.

There are a few guardrails in place for the United States. For a real estate company to be classified as a REIT, 75% of its total assets must be in real estate or cash, and 75% of its gross income must come from real estate-related sources such as lease payments. There must be a minimum of 100 shareholders after its first year, and under no circumstances can five (or fewer) individuals own 50% of the REIT’s stock during the second half of the taxable year. The SEC Investor Bulletin: Real Estate Investment Trusts (REITs) is available for those looking to read more.

While American REITs are considered corporations, their Canadian counterparts are regarded as mutual fund trusts. Second, the company must be incorporated under Canadian law, and a minimum of 90% of the fair market value of all nonportfolio properties held by the trust must be qualified REIT properties. To read more about the finer points, such as what qualifies a REIT property, certain tax advantages REITs can make use of, and the revenue tests REITs undergo, you can refer to the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)) or speak with a Family Wealth Advisor.

One major distinction that investors should be wary of is that Canadian REITs typically distribute 100% of net taxable income to unitholders, while American ones are only required to commit to 90%. This will likely have tax implications for the recipient of the distributions, depending on how the distribution is qualified: other income, capital gains, foreign non-business income, or even a return of capital.

How Do REITs Work?

It’s not often economically viable for a company to own the property where they conduct business. Given how expensive large buildings or properties can be, there is a significant risk associated with purchasing, building, or renovating these assets. Not only can this tie up capital and create cashflow issues, but it has a tendency to lock a business in place and make transitioning to a new location with better opportunities difficult.

REITs offer suitable alternatives to outright ownership, providing families or companies with short- and long-term leases on properties that would otherwise be costly to purchase outright. The REIT generates a reliable stream of revenue through lease agreements and may even sell its properties down the line for a significant sum.

What Are the Different Types of REITs?

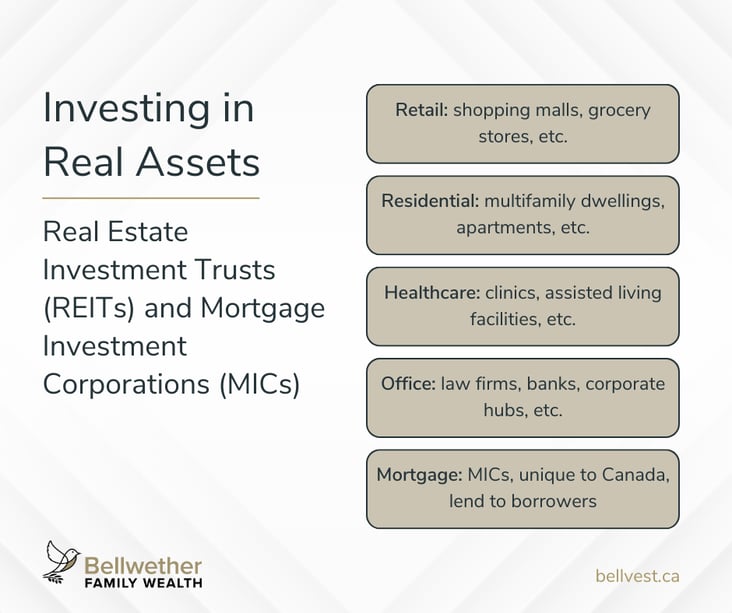

When investing, investors should be aware of what the REIT’s underlying portfolio looks like, as different sectors have various associated costs and property-specific risks. For example, renovating a multifamily residential unit will look quite different than repairing an entire office building. Here’s a list of how some companies show their preferences:

While most equity REITs treat leases as their primary source of income, Canadians have the option to invest in Mortgage Investment Corporations (MICs), which take a different approach altogether. While the former of the two usually owns and operates properties, the latter finances income-producing properties through private lending techniques. By providing liquidity to the real estate market for those in need, income is then generated through the interest on these investments and redistributed as dividends.

What Are the Advantages of REITs?

It’s unlikely that you have the capability to outright purchase a Fortune 500 company anytime soon, but you can still hold a stake by purchasing shares. Similarly, you can get exposure to the real estate market or institutional-quality assets through REITs.

Over time, investors can be rewarded by moderate capital appreciation thanks to the value of the underlying assets held by the REIT itself. But they aren’t just a waiting game. Over time, you can expect reliable and significant dividends, which makes them a suitable fixed income option for retirees.

They also present a strong case for portfolio diversification. As with most real estate, it has a comparatively low correlation to other assets. Publicly listed REITs are often more liquid than other alternative investments, which allows for greater mobility within your portfolio should you need to make certain changes.

Although REIT distributions function as dividends, they are not considered as such when it comes time to file your taxes and typically bow to your marginal rate. Thankfully, they can be safely held in registered accounts such as a TFSA, RRSP, RRIF, and the like. By housing your REIT investments in one of these tax-advantaged accounts, you can better optimize your portfolio. If you’d like to learn more about how tax efficiency can impact your portfolio, we’ve released an article here.

What Are the Disadvantages of REITs?

REITs, like any other investment, are not without flaws.

Although they have typically been seen as stable, reliable assets, they suffer from a specific correlation known as interest rate sensitivity. This concept is suitably named, as it measures how likely the price of an asset is to fluctuate in response to shifting interest rates.

If you were to look at recent performance, REITs have struggled to come to terms with the aggressive interest rate hikes implemented by central banks, hoping to cool the economy and get inflation below target levels.

But asset classes should rarely be evaluated in a vacuum. REITs are typically less volatile than other securities because interest rates are usually more stable than they have been over the past year. It’s worth noting that most income-oriented investments experience this very same sensitivity, so it is not an isolated condition.

As an extension of interest rates and financial struggles, lease delinquency or defaults can dampen performance as tenants leave and properties are left vacant. As such, some of the best managed REITs mitigate risk by finding reliable customers known as anchor tenants, which are typically larger businesses that can weather the storm of an economic downturn and have a proven track record. In some cases, certain sectors can be considered anchors as well. In the event of a recession where consumer demand falters, a grocery chain is more likely to be prioritized over a toy store.

How Are REITs Evolving?

Only the best ones are. While the fear that brick-and-mortar stores will be completely relegated to the sidelines by e-commerce platforms exists for a reason, it is somewhat exaggerated. According to figures put forward by the U.S. Department of Commerce Statistics:

- Estimated retail sales for the fourth quarter of 2022 were $1.785 trillion.

- Estimated retail e-commerce sales for the fourth quarter of 2022 were $262 billion, accounting for 14.7% of total sales.

It seems that consumers aren’t quite ready to give up on the benefits of physical, in-person shopping, even if the alternative is more convenient at times. Still, it is difficult to ignore the annual growth (6.5% from Q4 2021 to Q4 2022), which may have been a beneficiary of COVID-19 restrictions, increased household savings, and potentially sheer boredom. Further, as companies continue to embrace the hybrid work environment, data centres hosting essential communications tools such as Zoom stand to gain further traction as offices become less important for day-to-day operations. Will office REITs suddenly become obsolete? Most likely not, but this comparison illustrates the point that as the world evolves, investors must adapt to better position their portfolios.

As digital services continue to grow, their networking equipment and servers must be stored somewhere, and that somewhere is usually in data centres that operate around the clock.

While certain industry titans with ample resources (such as Alphabet, Meta, or Apple) may build their own centres in-house, many are hesitant to do so due to the capital requirements needed. One aspect of tech start-ups is their predisposition to be asset-light businesses; data centres are highly conducive to this model.

Are REITs Right for You?

REITs make sense in a lot of portfolios, but for our clients, we provide a more tailored approach to investment management. Depending on your risk tolerance, long-term goals, and a whole slew of other factors to consider, REITs may or may not be an appropriate part of your financial plan.

At Bellwether, we know which factors need to be considered: all of them.

Next Previous