“This is a question too difficult for a mathematician. It takes a philosopher.” – Albert A. Einstein

When asked about his income tax return, the 20th century’s most influential physicist admitted that he was not suited to understand the nuances. In a letter submitted to Time Magazine in 1963, it was noted that the late Einstein needed help from Leo Mattersdorf as an advisor.

If the mind responsible for groundbreaking theories and changing the scientific landscape struggled with taxes, anybody can. Let’s start with some basics: what are some tax-efficient investments available to Canadians?

What Does “Tax-Efficient Investment” Mean?

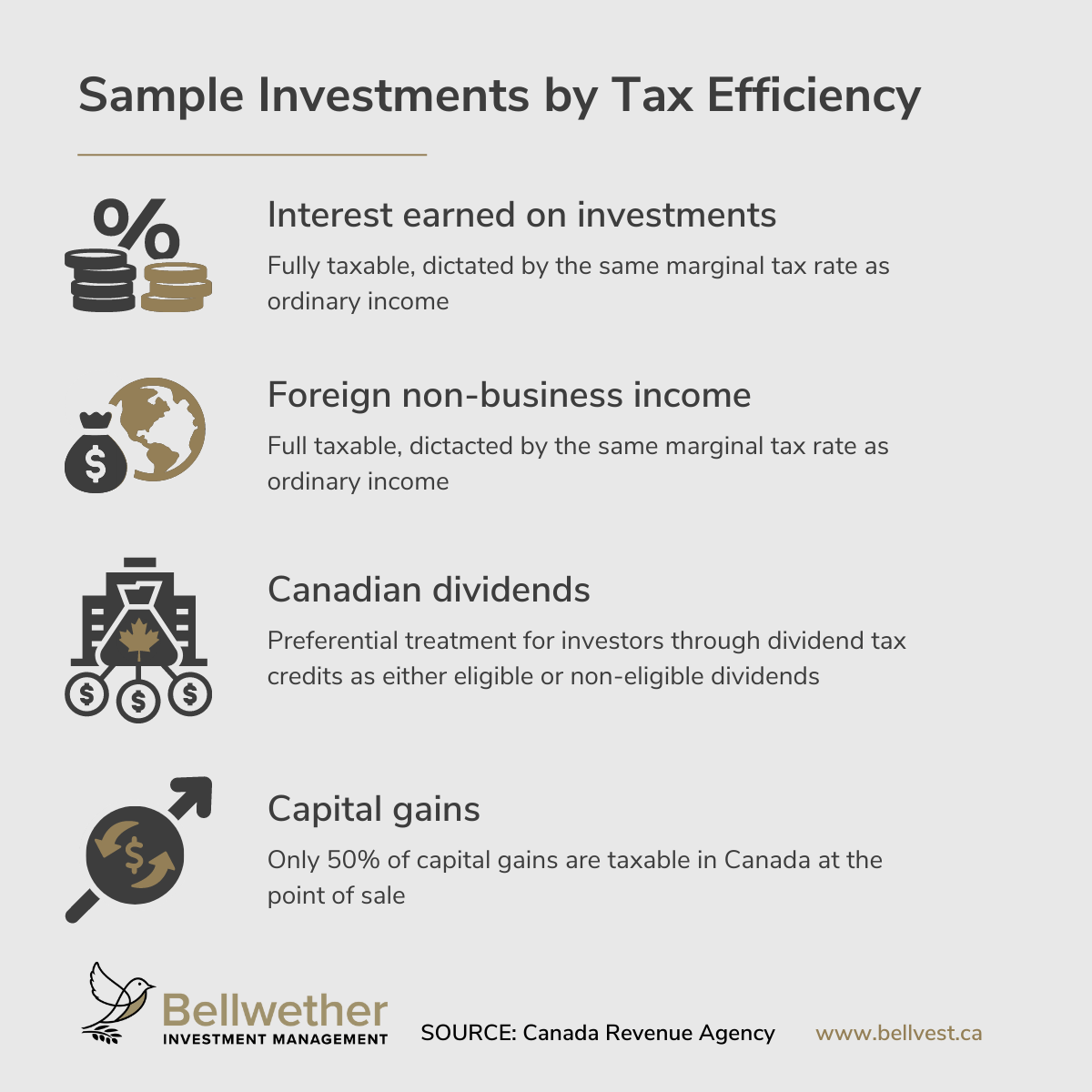

Tax efficiency means paying a smaller amount of taxes due to the structure of an investment. Lawfully, if an individual has a tax-efficient portfolio, they may keep more of what they earned based on their holdings because of how the Canadian Revenue Agency taxes different types of income.

It’s one of the few segments of investing you can control, and more importantly, a key aspect of maximizing returns after taxes. Here are a few examples ranked by their typical tax efficiency:

Should I Avoid Tax-Inefficient Investments?

Not necessarily. While interest and foreign non-business income have little benefit when it comes time to file your taxes, limiting your investment opportunities can be detrimental to any investor. As always, a well-diversified portfolio is usually more resilient to economic downturns or market volatility.

Although capital gains may be the most tax-efficient investment vehicle—pending changes to Canada's capital gains tax—it might not be wise to invest entirely in equity. You must first sell your asset for a profit, and nobody can control the invisible hand of the market. Capital losses can be useful for offsetting gains, but that’s only if you have gains to begin with.

Remember what we said earlier: tax efficiency is one of the few things you have control over.

How Can I Structure Investments for Tax Efficiency?

Diversification can come from different investment classes (fixed income or equity), geographical areas (domestic or foreign markets), accessibility (public or private/alternative investments), and, taking it a step further, where your investments themselves are being held.

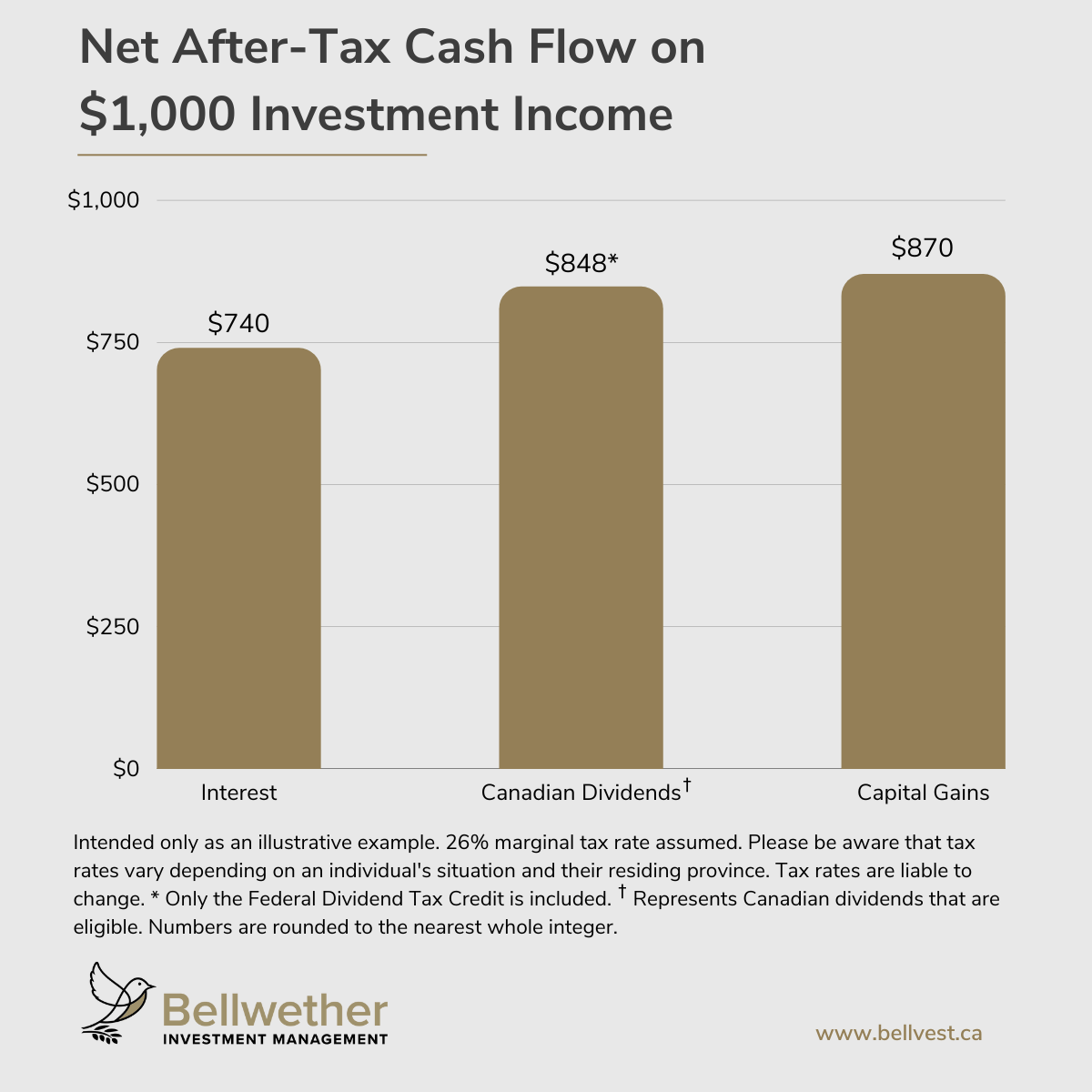

Depending on the asset, if you earned $1,000 in income on an investment without any further tax benefits in place, you would keep the following after taxes:

As seen in the chart above, capital gains are the most tax-efficient option of the three, while interest is the least, and Canadian dividends are somewhere in the middle. This is where a strategic portfolio structure with tactical asset allocation can benefit investors.

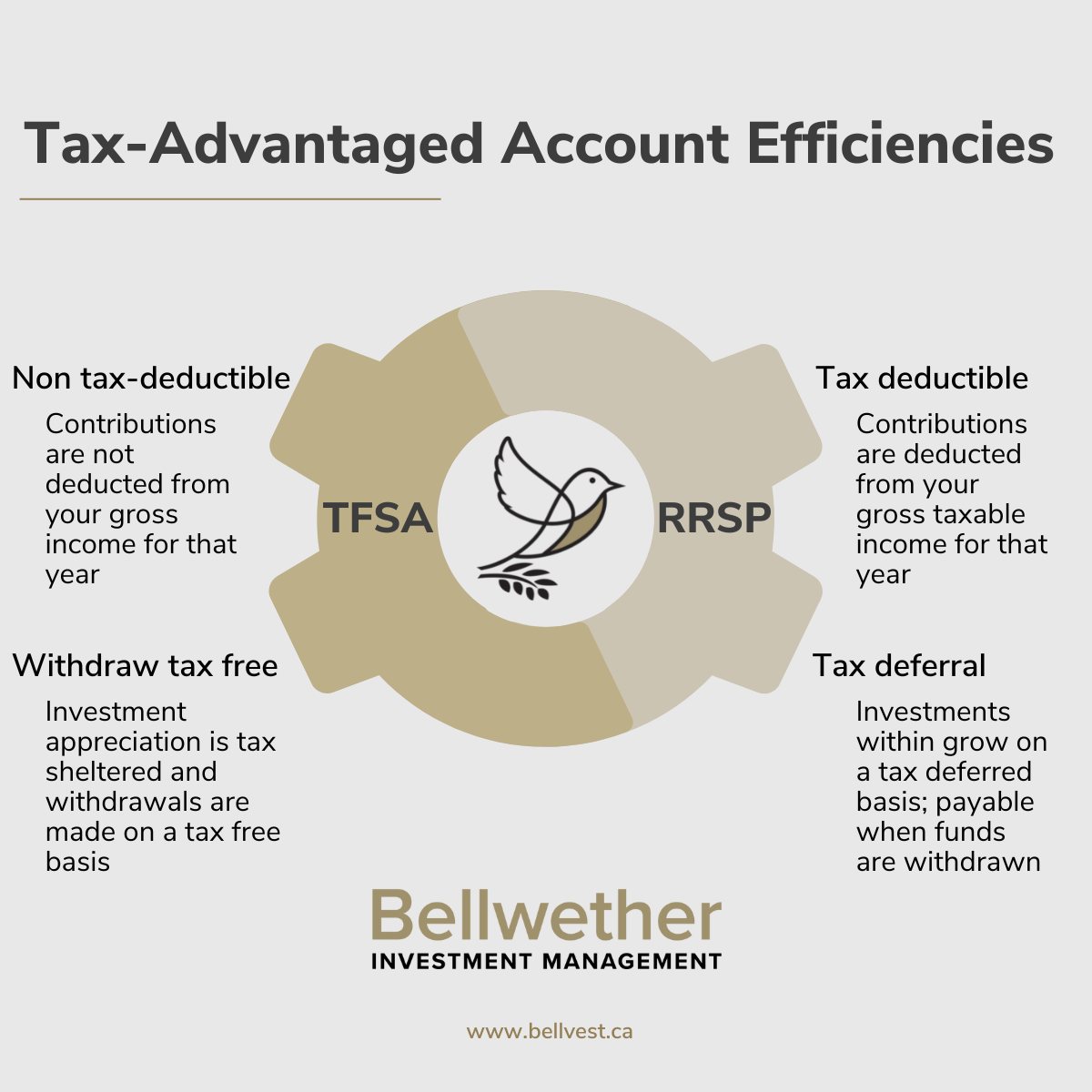

What many don’t understand is that RRSPs and TFSAs are not products themselves but simply tax-advantaged accounts that can hold investment products within them. In other words, they are useful tools for investors looking to tax-shelter their holdings. Here are a few benefits they can offer:

There are several strategies that investors can capitalize on to increase their after-tax income, with varying degrees of complexity. One of the simpler methods takes what we’ve explained earlier and puts it into practice.

As already tax-advantaged forms of income, capital gains, and eligible dividends can be safely held outside of these accounts. Another consideration is that if the value of your asset falls, you may find it more difficult to use those losses to offset gains in other areas if they are held in an RRSP or TFSA.

In fact, withdrawals from an RRSP are taxed at the same rate as interest income, meaning that even if you take advantage of the tax shelter of the account, you’ll be missing out on the lower tax rates inherent to these asset classes. Your RRSP should house your investments that are taxed at a higher rate, such as interest and foreign business income.

Contributing to your RRSP when you have a higher marginal tax rate can benefit you now and in the future. Deductions can help offset your income for the tax year filed, and when you’re nearing retirement and your income falls, your withdrawals will be taxed at a lower rate to supplement your lifestyle expenses. This may impact your government income-tested benefits (such as Old Age Security or Guaranteed Income Supplement) or be subject to government clawbacks.

In a sense, your TFSA functions in opposition. As contributions are not tax deductible and withdrawals are not taxed at all, it may be wise to contribute when you are making less income than you expect to in the future. Thankfully, TFSA withdrawals do not impact income-tested benefits in any meaningful way.

What Are Some Other Tax-Efficient Investment Strategies?

There are many, and they aren’t all easy to do on your own. Tax specialists take years to learn the nuances of efficient after-tax investing, including where to hold assets, how to structure resilient portfolios, and when to move investments around.

These strategies vary from person to person and from family to family. Some may work better for median-income earners, whereas others are more finely tuned for high-net-worth individuals. Find out how you can keep more of what you earn with a Bellwether Family Wealth Advisor. Einstein may not have understood taxes, but we can help you figure out yours.

Next Previous