“Letting go is hard. But harder still is not letting them reach their full potential.” — Anonymous

When it comes to threats facing client-advisor relationships and your long-term financial plan, it’s unlikely that "adult children" come to mind. But in reality, failing to warm your adult children to your advisor can cause significant issues down the line.

There’s a chance that one day you will be unable to care for yourself or make sound financial decisions for yourself. At this point, your power of attorney will begin to make those choices. If the individual with this authority isn’t prepared or has a conflict of interest, the fallout can undo decades of planning.

Great client-advisor relationships last a lifetime, but here’s how we try to create ones that last even longer.

Why a Power of Attorney Should Be in Your Financial Plan

Your financial plan should be drafted with your entire life in mind, if not longer, and have the ability to pivot or account for significant, life-altering events. Whether it’s having children, going through a separation, changing careers, or even just realizing you want something different out of life, a talented financial advisor can help you through these times.

The common thread between these examples is their relative unpredictability; there’s no real instrument to protect against these possibilities. They are dealt with as they occur.

A different scenario, however, is the possibility of becoming incapable of making your own financial decisions. This is one you can plan for, which is why we recommend including a named power of attorney in any financial plan you and your advisor create.

Choosing the Right Person for Power of Attorney

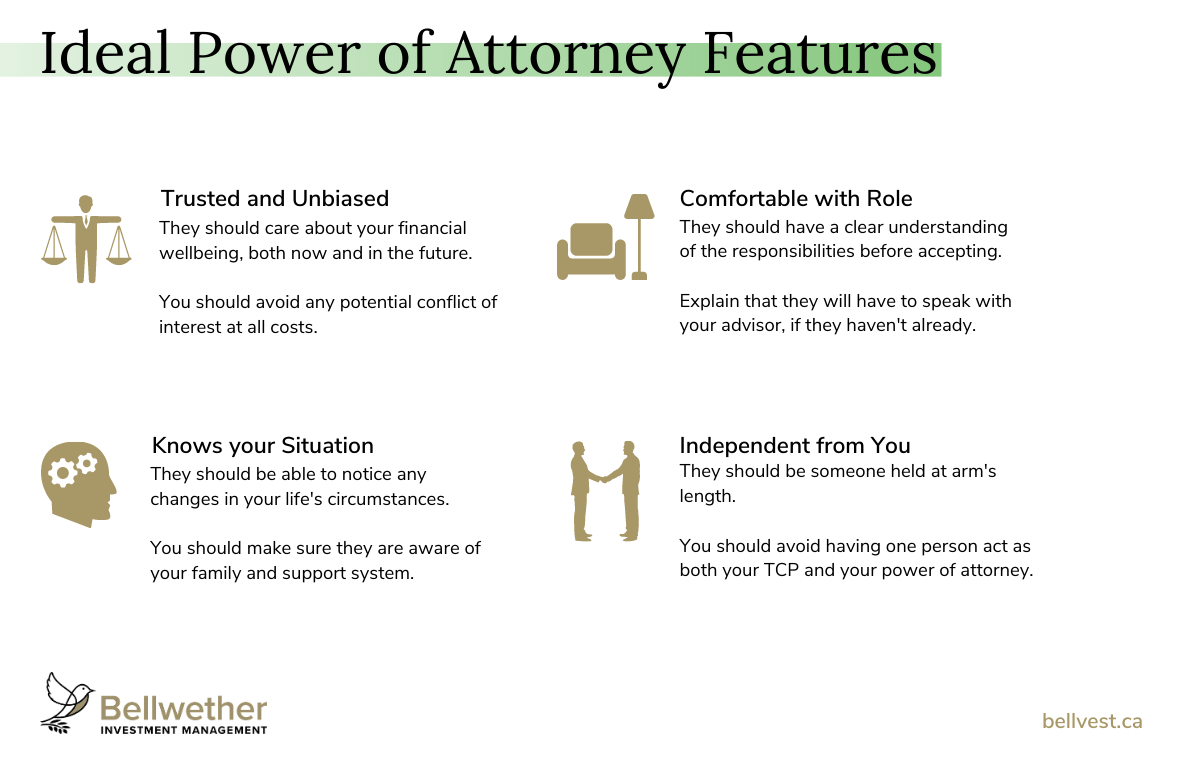

Like naming a trusted contact person, which we also strongly recommend to protect clients, there are certain characteristics you should consider when naming a power of attorney:

In most cases, an adult child won’t exhibit all these traits. One concern is the possible conflict of interest that arises from the stress of their parent’s health and the financial implications of inheritance.

Trust Takes Time, Client-Advisor Relationships Take Years, Plans Take Decades

It takes years, if not decades, to foster authentic and meaningful advisor-client relationships. From the very first meeting to discovering underlying motivations, priorities, or core values, these partnerships should always be growing.

Once your power of attorney is given the authority to make decisions on your behalf, it’s as if the client-advisor relationship has gone back to square one if they haven’t been introduced to your advisor yet.

In most cases, square one isn’t such a bad place to be. It’s where the client and the advisor learn if they are a good fit for each other. It’s where trust, the foundation of any relationship, begins. The stakes aren’t high; an account hasn’t been opened, and for all intents and purposes, there isn’t any risk associated because no investment capital has been put forward yet.

Although designed to protect your wealth and family, appointing the wrong power of attorney can be disastrous. There could potentially be millions of dollars within the investment account, and suddenly the adult child, who would understandably be in an emotional state, is forced to step into action and decide what is best.

Without an understanding of their parents’ financial plan, history, strategy, or wishes, the situation can result in unilateral decisions that don’t consider the whole picture. They may see the advisor as an unnecessary component of their family’s well-being, thinking in dollar terms when looking at the management fees and demanding that the advisor explain the value provided for the amount paid.

This is more likely to cause a rift between the advisor and the adult children of their client. According to research from Cerulli Associates, only 13% retain the services of their parents’ advisor once inheritance rolls around. A sobering statistic.

So, how can you avoid this? How can you convince your adult children to stick with the advisor that built the family’s wealth up until now?

How Can a Parent Ease the Transition?

It isn’t rocket science, really. Consider what the root of the issue is and address it sooner rather than later. The leading cause often comes down to unfamiliarity.

Your adult child is, in their mind, trying to do the best they can to protect you and everything you worked for. If the first time they meet your advisor is by your bedside, they’re likely to hear alarm bells ringing. Introduce them to each other as soon as you can, especially if they have power of attorney. Bring them to meetings, ask them for their input, include them in the decision-making process, and discuss the reasons for your investment philosophy and the goals you’re working towards.

By building a relationship with your advisor alongside your adult children, you’re more likely to create a stronger bond between the advisor and the family as a whole.

How Can an Advisor Ease the Transition?

It may be up to the advisor to break the ice by encouraging their client to introduce their adult children, but if this hasn’t happened, it becomes a race against time.

The client-advisor relationship takes years to build. Sadly, your adult children won’t have that same opportunity to foster trust. The learning curve may look as sheer as a cliff face—and that’s because it is. It’s the advisor’s job to educate the adult children as quickly and efficiently as possible in order to get them up to speed and on the same page as the plan. Failure to do so can result in hasty decisions from the adult children that end up being harmful or disruptive to their parents’ wellbeing, financial or otherwise.

How Does Bellwether Approach This Issue?

We recognize these potential issues well before they come to light and have a firm belief in transparency and open communication. Our Family Wealth Advisors treat the entire family as a unit, creating financial plans that are designed for continuity between generations.

Meetings shouldn’t end with the account holder. For us, they only begin there.

Next Previous