“A million dollars isn’t what it used to be” — Howard Hughes

Born in Texas in 1905, the (in)famous business magnate's words still hold weight. Suddenly, the romanticized goal of $1 million is under scrutiny as a realistic, sustainable nest egg for retirement.

Inflation may eat away at your savings, but if you understand how to plan ahead and use time to your advantage, you can adapt. The buying power of a dollar is not the same as it was yesterday, but here are a few tips to stay ahead in an ever-changing world.

Why is $1 Million No Longer the Retirement Goalpost?

Several factors have sent inflation soaring, and whether it’s $100 for groceries, $10,000 for a car, $100,000 for a down payment, or $1,000,000 for your retirement, a dollar isn’t what it used to be.

Inflation isn’t exactly a new concept, and fluctuations should be expected. The recent, drastic increases have been worsened by issues like increased household savings accumulated during the pandemic, supply chain disruptions, and demand exceeding supply.

More recent events have also materialized. With trading sanctions imposed on Russia and OPEC+ slashing their daily production, energy costs have climbed. On a more geopolitical scale, we are also seeing globalization—nations connected through trading and development—deteriorate. As countries isolate themselves, global trade becomes less efficient, and this leads to higher production costs that are often passed on to consumers.

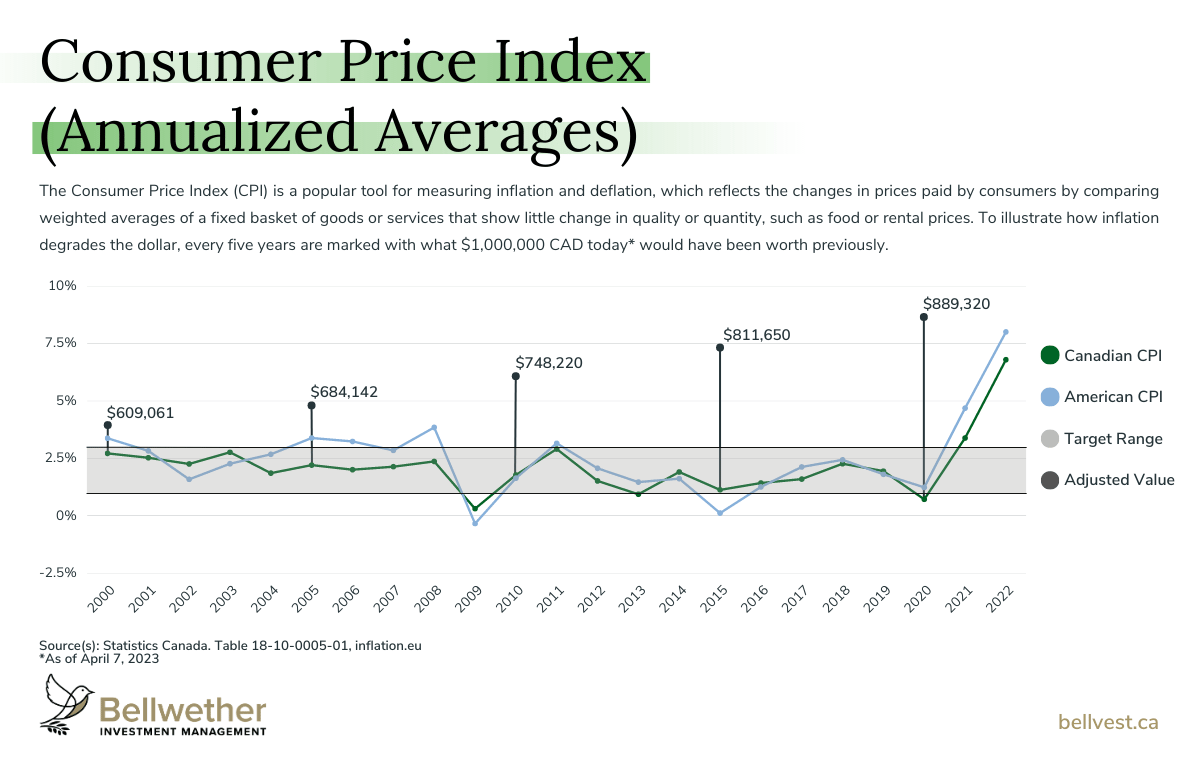

Reviewing the earlier chart can help explain inflation in simpler terms. In 2000, the average annualized Canadian CPI was 2.72%, but it decreased to 2.21% in 2005. It's important to remember that inflation compounds over time and relies on previous growth.

To understand this better, think of inflation in contrast to interest. If your savings grow at an annual rate of 2%, and inflation is also at 2%, you won't significantly increase your wealth. Educated investors often move their money from bank accounts to assets that can counter inflation and rising expenses.

Will Inflation Impact My Retirement?

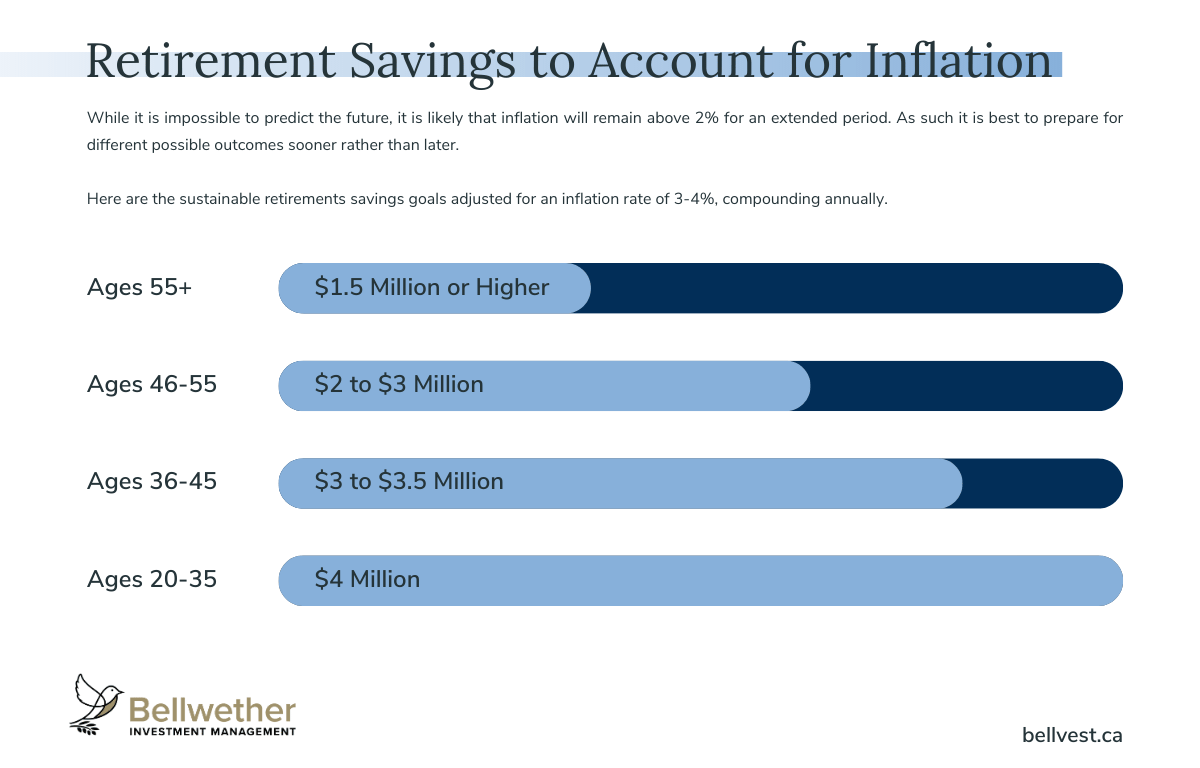

Due to the compounding nature of inflation, age plays a crucial role in how much rising costs will impact your retirement savings.

Retirees are less likely to feel the bite, and having a holistic, adaptive financial plan can help compare future expenses to how much income your portfolio is generating. In an ideal scenario, your portfolio’s appreciation should be prepared to outpace inflation, and withdrawals should be minimized to 4% or below; anything beyond that means you are likely spending some of your investment capital.

But what about individuals approaching retirement or just starting their careers?

Time acts as a double-edged sword. The further out you are from retirement, the more room you’re forced to give to inflation and push back your goalposts; on the other hand, it provides more opportunity to prepare yourself accordingly.

How Can I Get Ahead of Inflation for Retirement?

Planning and execution are key factors to consider, without burying the lead. Making impulsive decisions can lead to errors, and having a well-thought-out strategy is often an investor's best ally. Here are a few ways you can get ahead.

Simple formulas like “aim for 80% of your pre-retirement income” are a loose way to plan your future and ignore individual factors that can alter your future expenses. A personalized, tailored approach is more likely to yield the results you are hoping for—this is why authentic, meaningful advisor-client relationships are so valuable.

By understanding your needs, dreams, and worries, an experienced Family Wealth Advisor can listen and help guide you and your loved ones toward your goals. Do you plan on downsizing? Will you spread your wings as a snowbird? Are you helping your child buy their first home? Does your cottage need a facelift? Does your family have a history of health issues? Each of these details can move the needle on what you’ll need to fund the lifestyle you’re hoping to create and sustain.

Once you have a well-defined plan in writing, the next step is sticking to it. To use a simple concept as an example, saving on a regular basis can help you ward off inflationary pressures. By scheduling automatic transfers of 20% from your chequing account to your savings account, you accomplish three things:

-

you nurture a habit of spending less;

-

you add to your investment capital that can grow over time;

-

and you can safely spend the rest guilt-free.

Time may bolster inflation, but it can also work to your advantage and grow your net worth. They weren’t kidding when they said time is money.

To highlight the importance of early savings, let's examine how to achieve a $2,000,000 balance in an RRSP account. Assuming an annual growth rate of 7%, through skilled investment management, we'll create two investor profiles:

-

Investor 1 is 45 years old and would like to retire at the age of 65. They have already contributed $200,000 to their RRSP during their career and will annually contribute $30,000.

-

Investor 2 is 25 years old and would like to retire at the age of 65. They have not made a single contribution to their RRSP during their career and will annually contribute $10,000.

Can you guess what their balances will be upon retirement? Investor 1 may have had a significant head start and made larger contributions, but at 65, their RRSP balance would be approximately $2,089,892. Investor 2, who used time to their advantage, would retire with an RRSP balance of around $2,136,096.

The cardinal rule for setting yourself up for retirement is simple—save early and save plenty. While the above example doesn’t account for inflation, Investor 2 could increase their regular contributions once they progress in their career, reinvest in their portfolio, create a budget, and more.

How Can A Financial Advisor Help?

For these reasons, Family Wealth Advisors have multigenerational benefits. By taking the time to build relationships with not only the primary income earner but their children as well, your personalized financial plan can give them the head start they deserve. That’s why we’ve set up our management fee structure to better serve families. When your children open an account, they get the same household rate, regardless of the account size.

Although it is impossible to influence economic or market conditions, there are three factors that are within your control: how you decide to save or invest, the time you give them to appreciate, and helping your children get ahead in life.

Next Previous