“Energy is essential for development, and sustainable energy is essential for sustainable development.” — Tim Wirth

For a former member of the Senate born in 1939, Wirth was considered a trailblazer in the world of low-carbon energy alternatives, natural gas, and environmental issues. Once an unimportant subject often minimized by more pressing contemporary issues of the 20th century, our reliance on oil has ballooned into both environmental and economic concerns.

But when issues arise, opportunities often follow suit. As astute investment managers, it’s our duty to identify them ahead of time and prepare accordingly.

Russian Tensions and Oil Sanctions

While nobody could have expected Russia to invade Ukraine, it is disheartening to see an entire country thrown into disarray. As noted in a previous blog article, heightened volatility was noticed in stocks, bonds, commodities, and currencies during the fallout.

In a swift response to the aggressors, many nations placed sanctions on Russian goods. Even prior to the bans, the European Union (EU) faced its own issues with relying too heavily on cheap natural gas from Russia. As their largest energy provider, Russia’s decision to slash gas supplies to EU states by 88% during 2022 reminded them of the dangers of overconcentrating on any one supplier.

With wholesale prices pressured by a supply crunch and a possible energy crisis on the horizon, governments realized they needed something more and took a page from investment managers: diversification of energy sources and options.

Energy Alternatives: Wind Farms

Germany produced a record-breaking amount of wind energy on January 4, 2023. While wind clocked in at 50,000 megawatts (MW), fossil gas was a tenth of that, at approximately 5,000 MW generated. Going back five years, wind accounted for about 13,500 MW, while fossil gas weighed in at 9,600 MW.

New mandates put forward show that Germany hopes to source 80% of its needs through renewable energy by 2030. Government subsidies will hopefully incentivize domestic and foreign investment to help them achieve this objective. To make this a reality, approximately 1,500 wind turbines need to be erected annually; 551 were built in 2022.

Germany, however, isn’t the only one with lofty goals. During a summit in Belgium’s North Sea port of Ostend in April 2023, nine nations expressed similar aspirations. Belgium, the Netherlands, Luxembourg, France, Britain, Ireland, Norway, and Denmark have all agreed on more than quadrupling the current level of production by the end of the decade to 120 gigawatts (GW) and, by 2050, achieving 300 GW.

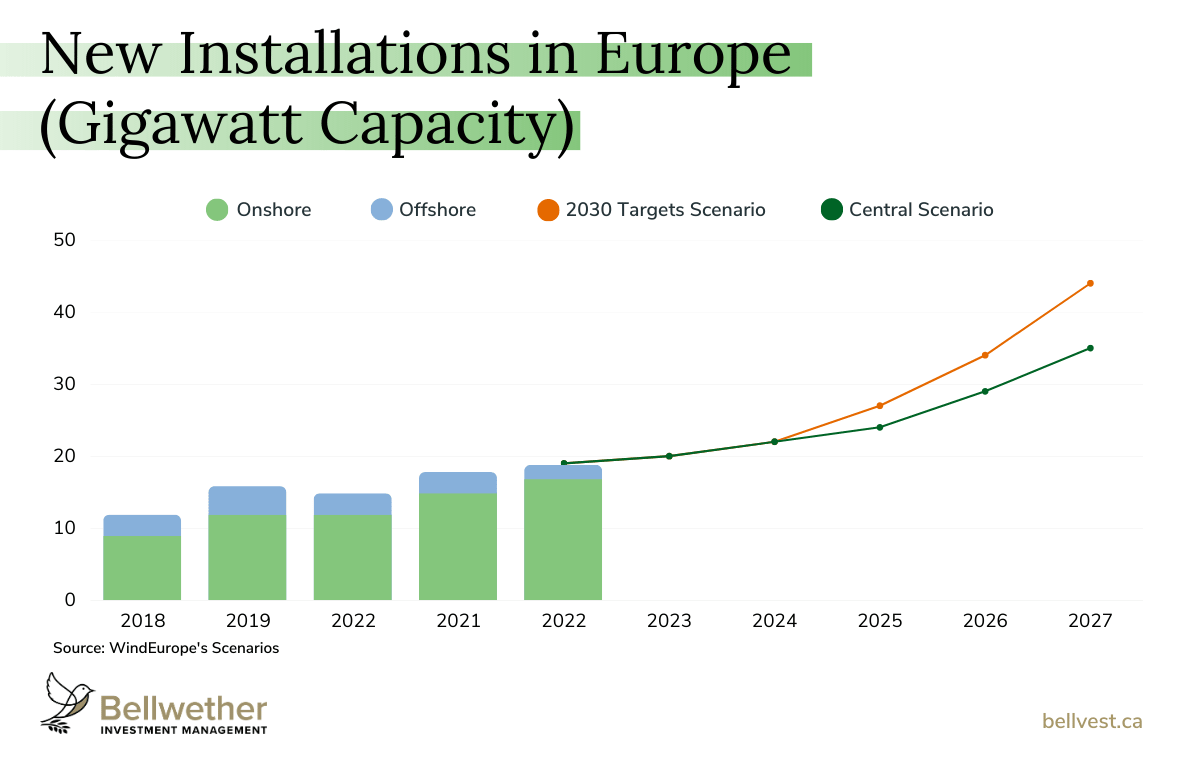

While new project developments (and repowering older model turbines) have been impressive so far, the largest setback seems to be permitting issues. Recognizing this challenge, the EU has been flirting with new mandatory 2-year permit deadlines to help ease backlogs. If these revisions to the 2018 EU Renewable Energy Directive are enacted, WindEurope forecasts a substantial lift for an already thriving industry.

Energy Alternatives: Liquid Natural Gas (LNG)

Coming full circle, LNG is a rapidly growing industry in Germany, where the first practical compressor machine was created by Bergdorf-born engineer Carl von Linde. Whether it’s building government-funded LNG terminals (a first for Germany) or contracting several floating terminals, energy independence has become a priority under the LNG Acceleration Law.

Craig Ellis, vice president and portfolio manager, notes that “while the Canadian government has been slow to capitalize on our capacity to export low-cost natural gas to other countries,” it has also created a global investment opportunity in countries revamping their energy infrastructure.

LNG development differentiates itself from turbine construction through time and capacity. According to Matthias Frauen, his latest turbines took seven years to complete when planning, permitting, and construction were all wrapped up. This isn’t to say all projects are similarly drawn out, but he does contrast it to Germany’s first regasification terminal launch, which took only ten months.

There are two things to consider given project timelines. On the one hand, LNG is simply natural gas that is condensed into a liquid state for shipping. It is not a carbon-free source of energy, but it is the cleanest fossil fuel available. On the other hand, it is also easily accessible, as already established production lines simply need a ferry across the ocean.

For the time being, LNG helps alleviate the immediate stress of Germany’s energy issues. While the EU works towards becoming a climate-neutral bloc by 2050, transitional energy sources are required to get there. Ellis recognizes this need for LNG as a stopgap, but still has his eyes set on the future by investing in “a significant number of companies that have become leaders in the development of renewable fuel sources across the globe.”

In regards to capacity, a recent internal analysis casts doubt on LNG projections being overinflated for their needs. At face value, the document suggests that “in no demand scenario does the expansion of regasification capacities” make sense for the country’s energy consumption.

Seemingly, the plan is for massive overcapacity, and the analysis forecasts that new terminals would run at 50% capacity if other climate and energy policies are achieved.

But here’s where it gets interesting: people may be at risk of missing the bigger picture if they focus on overcapacity without considering worst-case scenarios.

When the fear of a Russian-fabricated energy crisis first materialized, nobody was expecting the second warmest winter on record to help curb demand for gas. In short, the perfect storm of record-breaking wind production and abnormal weather conditions provided relief from a potential energy shortage.

Three risks were identified that could make these LNG terminals vital for European energy independence: insufficient gas stores, harsh winters, or distressed neighbouring countries in need of energy. In any of these scenarios, the safety net of overcapacity can help the EU sustain itself.

Why Alternative Investments Matter to Bellwether Clients

Because we have exposure to both industries. Betting on continued record-breaking turbine output and ignoring the risk of cold winters would be irresponsible; proper diversification requires planning for multiple scenarios. If wind energy were to stumble, LNG infrastructure could offset this shortfall and hedge against catastrophe.

We’ve introduced investments that complement one another to better protect against downside risk. Whether it’s market volatility or unpredictable weather conditions, preparation is key.

As the world weans itself off fossil fuels, our team will continue to identify alternative investment opportunities during transitional periods. At the end of the day, decisions like these can be the difference between a good portfolio and a great one.

Next Previous