“Each year's regrets are envelopes in which messages of hope are found for the New Year.”

– John R. Dallas Jr.

Goal-oriented behaviour, like setting new-year resolutions, can be surprisingly detrimental to your overall success… but having a systems-oriented frame of mind often leads to better outcomes.

One leads to results, the other relies on them—here are a few insights to set yourself up for success and make the most of 2025.

Goal-oriented Behaviour

The new year offers a world of opportunity (and a significant amount of fresh gym memberships), but sometimes it comes at the cost of feeling overwhelmed. James Clear, the award-winning author of Atomic Habits, accurately notes that “if you save a little money now, you’re not a millionaire.”

The problem that many people run into, however, is that if halfway through the year they haven’t lost 20 of their 40-pound goal, made $500,000 of their $1,000,000 earnings target, or otherwise, they may lose hope and give up.

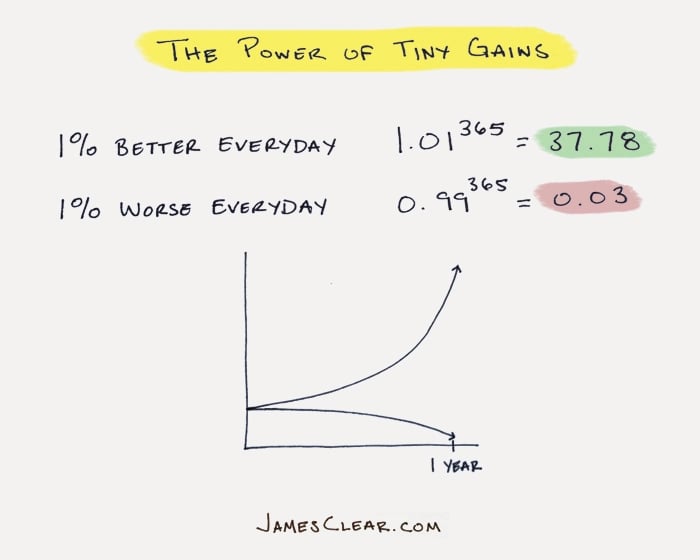

This leads us to the fundamental problem of measuring your success based on arbitrary goals: progress is not linear. This may sound deflating at first, but the core idea of his novel considers how minor, habitual improvements compound into greatness.

Systems-oriented Thinking

Another issue to consider with worrying about goals is the idea of what comes next. If you reach $1,000,000 in savings, do you suddenly put your feet up? By creating systems or rules (“I’ll be more cautious of my spending habits” or “I’ll put aside 15% of my pay cheque each month”), there’s no goalpost to celebrate other than continuing with what’s helping. In a way, there’s no end to your progress.

Let’s put it more clearly with a geometric sequence model, which is the basis of compound interest. If you started saving $1 a day on January 1st, compounding daily at 1% for 365 days, your savings would be roughly $3,678 by the end of the year!

Applying this mentality to other aspects of personal finances can be equally beneficial.

Investing in Yourself

If you’re reading this, you’re already doing so. Investing in yourself can come in several forms:

Physical Health

Being healthy can be relatively easy at a young age, but developing an appetite for physical activity can help your future self acclimatize to staying in shape. The National Library of Medicine published a study that suggests sedentary lifestyles increase the risk of all-cause mortality, which presumably comes with significant healthcare costs down the road. Health is wealth, they say.

Emergency Funds

The past few years invited several difficulties for most of us, ranging from pandemic lockdowns to climbing interest rates. With thousands of workers furloughed and new homeowners struggling with higher mortgage payments, now may be a better time than ever to establish an emergency fund or top up an existing one. In most situations, it’s better to have access to emergency funds instead of dipping into your investment portfolio or savings accounts. Robbing yourself of investment opportunities or your retirement security is costly, but with proper planning, it can be avoided.

Paying Down High-interest Debt

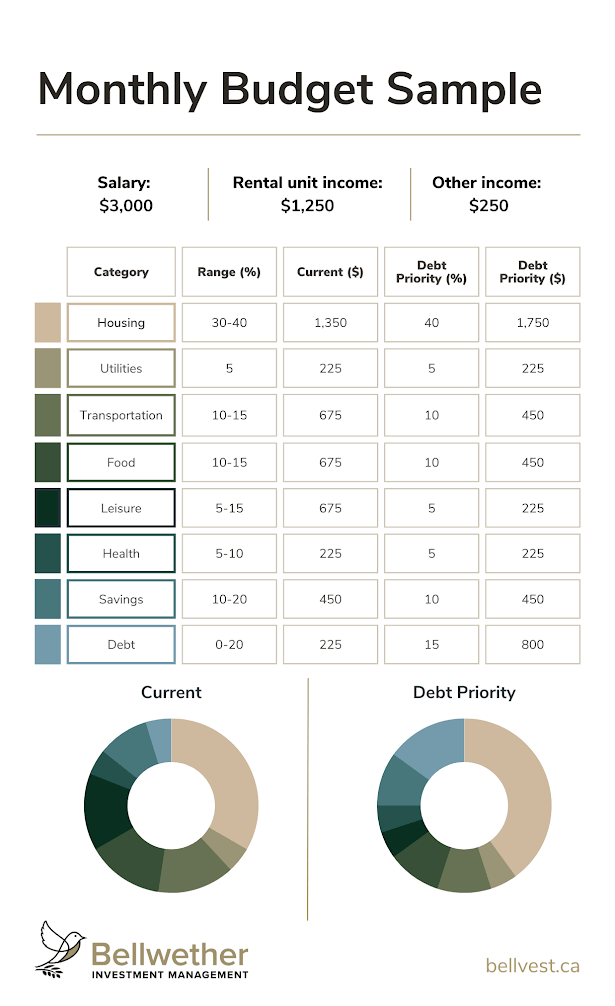

We’ve written at length about debt management, but it’s still worth mentioning—Canadians are taking on record debt, and so is the government, which doesn’t exactly help. Consider readjusting your monthly budget to make debt reduction a priority, as our current high-interest rate environment can come with significant issues: James Clear would agree that even 1% can have significant, long-term impacts.

Saving More Doesn't Always Mean Spending Less

Here’s one you may not have been expecting: spending can be good when done correctly. As we just covered, paying down your debts can feel like money lost, but you’ll thank yourself in the future. There’s a rather complex formula regarding the future cost of a dollar, but here’s a simple explanation—if you were to put a dollar in a piggybank today and not have access to it, how much would it need to appreciate over one, five, or even ten years for it to be worth investing?

Take inflation as an example. With savings account interest rates floating around 3% (or certain 4.60% promotional rates dropping to 0.35% after the first 153 days), there’s a good chance that leaving your money sitting in a savings account isn’t doing you too many favours, given recent CPI reports from the Bank of Canada and the opportunity cost of neglecting your investment portfolio. In instances like this, it’s worthwhile to consider what your relative returns are compared to what professional asset management could do for your future.

Financial Planning

It’s a little funny to see this one come last, but frankly, it’s because everything else is a part of it. From tax-efficient investing (something we’re so passionate about that we’ve released an article with some pointers) to establishing a legacy you can be proud of while still living the life you want to, a strong financial plan can make all the difference in your life.

As one of our Family Wealth Advisors, Chris Jardine, likes to say, a good financial planner knows your goals, but a great one understands the motivations behind them. Few things in this world can provide greater benefits than a personalized financial plan that adapts to your evolving needs and grows alongside you. If something unexpected happens, the best plans are ready to pivot and adjust as needed.

A Closing Note

It’s just the 25th year of the 21st century of the 2nd millennium—there are plenty more to come. While there’s nothing wrong with setting goals to help ensure this is a good year, think of it as a gift to build habits that make every year after this one even better.

We’re here to help you build the future you deserve.

Next Previous