“Many delight more in giving of presents than in paying their debts”

– Sir Philip Sydney

Even so long after the fact, the 16th-century poet’s quote still stands tall in the world of personal finance. Ironically, his words may have fallen on deaf ears for his father-in-law, who almost went bankrupt due to his reckless spending on the elaborate funeral procession for the late Sydney.

In memory of one of the Elizabethan age’s most prominent figures, let’s unpack the knowledge he left for us: is debt as much of an unsung issue as he suggests, and what are some effective methods to pay down debts more efficiently?

Are Canadians Taking on too Much Debt?

Early in December of 2022, Statistics Canada released its third quarter report on the National Balance Sheet Accounts (NSBA) and the Financial Flow Accounts (FFA). The NSBA are composed of balance sheets across all sectors and subsectors in the country to assess all national non-financial assets as well as all outstanding financial asset-liability claims. On the other end, the FFA express how capital is being lent or borrowed by measuring transactions across the nation. The consolidated report provides valuable insight into Canada’s overall economic health.

The data shows that on a “seasonally adjusted basis, household credit market debt as a proportion of household disposable income increased to 183.3% in the third quarter” of 2022. In simpler terms, for every dollar of after-tax income across Canadian households, there is a credit market debt of $1.83. This can largely be attributed to several factors, but mortgages account for a few extra stars in the constellation: mortgage debt surpassed the $2 trillion mark, while non-mortgage debt weighed in at over $722 billion.

The Bank of Canada (BoC) may have been correct in pointing out elevated levels of household indebtedness and housing prices as the first two key vulnerabilities in the Financial System Review–2022 (FSR) publication. Coupled with the increasing amount of variable rate mortgages with longer amortization periods being taken out, the trigger rate (which you can read more on here) may negatively impact Canadians who aren’t properly prepared.

That being said, the BoC admits that in “nearly every” annual issue of the FSR they “warn about the high debt that many [Canadians] are carrying, and [they] warn about elevated house prices.” Thankfully, data from the National Balance and Financial Flow Accounts fourth quarter report shows that household net worth rose by 1.2%. The caveat to this is that the value of household residential real estate suffered and declined by 1.4%. Combined with interest rate pressures, this petering off led demand for mortgages to lows that haven’t been seen since the start of 2019. In other words, Canadians now have a credit market debt of $1.81 for every dollar of after-tax income, compared to the previous quarter. Hopefully, this number continues to fall, giving the BoC less reason to issue warnings about housing prices and heightened debt levels.

Understand Your Habits, Make a Budget

It’s spoken ad nauseam for a reason: making a budget is one of the most effective ways to get your finances under control. A Bellwether Family Wealth Advisor can help you create a comprehensive financial plan that can include (re)evaluating your short- and long-term goals, differentiating between compulsory (food, housing, and other essentials) and non-compulsory (streaming services, leisure activities, and the like) expenses, and identifying your sources of income in light of your outflows.

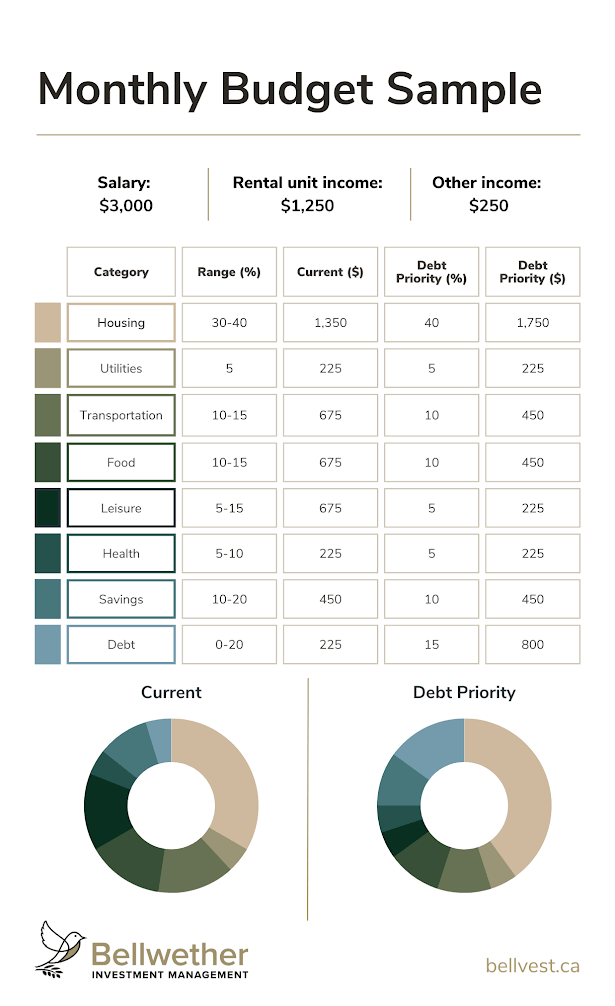

Not everyone is so lucky to have an expert on their side to create a resilient and adaptive plan, but that doesn’t mean you can’t make some progress yourself. Take stock of where exactly your money is going. After a month or so, you’ll have a better understanding of your spending habits, which should give you an idea of where you can improve and be more responsible. You may find certain areas that are “nice-to-haves” and not “absolute-necessities,” which can show you where you can shave down spending and redirect that towards paying down your existing debt. An example may help:

How Can I Pay Off My Mortgage Faster?

In the above example, the expenses that went down were transportation, food, and leisure. Restaurants were visited less, public transit was opted for, and spending more time at home instead of going out all contributed to increasing the amount of money put towards debt repayment. In this scenario, plenty went towards altering mortgage payments, which can be done by:

- Making more frequent payments

- A 25-year amortization period with a 5-year term on a $500,000 mortgage at 5% interest makes monthly payments $2,908.02.

- Under those same conditions, with the only change being accelerated biweekly payments ($1,454.01), you could save $60,434.30 in interest payments over that amortization period.

- Making additional lump sum payments

- Assuming a closed mortgage, under the same conditions as above with biweekly accelerated payments, the addition of an annual prepayment of $5,000 would save you $68,707.60 in interest payments over that amortization period.

- Under monthly payments with no lump sum payments, the annual mortgage expense is $34,869.24, but by introducing the two increases (bringing the annual total to $42,804.26), the homeowner would save $129,141.90 over the 25-year amortization period.

- Increasing your regular payment amount

- It is worth noting that many mortgage contracts will not allow for payment sizes to be reduced once they have been raised.

Lenders often refer to these additional payments as prepayment or prepayment privilege, but it is important to note that most mortgage contracts impose certain limitations—overages typically incur penalty fees. These limitations vary from lender to lender, and it is important to thoroughly understand your contract or consult with a mortgage professional before attempting these maneuvers. The above figures are intended as an illustrative, hypothetical example using the Canadian government’s mortgage calculator and do not account for the many possible variables such as refinancing, re-amortizing, and the like.

How Can I Pay Off Debts Efficiently?

Once you’ve familiarized yourself with your budget in regards to how much money you have coming in, what your expenses are, and how much you’ll be putting away for the long-term, you can apply similar principles to your other debts as you did with your mortgage. At its core, you have two vital aspects to consider: the principal amount and the interest accrued thereon.

There are several strategies you can deploy to better situate yourself, but for the sake of brevity, we’ll consider the two leading camps.

Prioritizing High-Interest Rate Debts

Some people encourage focusing on higher-interest debts to reduce the amount of interest accumulated over the long term. A good place to start is to list your outstanding loans in descending order of interest rates and familiarize yourself with the minimum payments needed to cover each one. Make each of them on time, and put the rest of your debt repayment budget towards the top-listers. Again, an example may help:

- You set $500 aside each month for repayment.

- You have five loans in the following descending order, each with a standard minimum payment rate of 2% of the loan balance plus the base interest rate.

- $1,000 with a 5% interest rate (minimum payment of $70)

- $2,500 with a 3% interest rate (minimum payment of $125)

- $800 with a 3% interest rate (minimum payment of $40)

- $2,000 with a 2.5% interest rate (minimum payment of $90)

- $300 with a 2% interest rate (minimum payment of $12)

Your collective minimum payment in the scenario would be $337, leaving you with $163 to put towards the principal amount of the first loan and bring it down to $837. In other words, the minimum payment would drop from $70 to $58.59 the following month. After a few payment periods, you could eliminate it altogether and work your way down the list.

Prioritizing High-Balance Debts

Although there is nothing wrong with the above strategy, the world of personal finance has room for different opinions. Another school of thought subscribes to the idea of squaring away debts with higher balances. The applications are similar to one another, but let’s work with the five loans outlined above under the same terms and conditions. This time, however, they’ll be ordered differently:

- $2,500 with a 3% interest rate (minimum payment of $125)

- $2,000 with a 2.5% interest rate (minimum payment of $90)

- $1,000 with a 5% interest rate (minimum payment of $70)

- $800 with a 3% interest rate (minimum payment of $40)

- $300 with a 2% interest rate (minimum payment of $12)

You may notice a pattern emerging here. While the debts are organized by balances owed, they also happen to be ordered by the minimum payments as well. This may not be the case for all loans and is largely a function of the balance in tandem with the attached interest rates, but it illustrates a useful point: higher principal amounts can be equally as detrimental as higher interest rates. After paying the minimum amounts and applying the remaining $163 to the first figure, the new balance would be $2,337 with a minimum payment of $116.85 instead of $125.

Although it may take longer to pay off and move on to the next target, you’ve taken one of the biggest weights off your income-to-debt ratio. In fact, some even take the opposite approach by paying off their lowest-balance debts in quick succession to gain momentum and confidence in their loan management abilities.

What is Debt Consolidation?

Consolidation stands in opposition to one of any investor’s greatest allies, diversification, but that doesn’t mean it’s completely devoid of value. If you find yourself struggling to keep up with several different loans hanging over your head, debt consolidation may be right for you. The idea is that you can consider applying for one loan to take care of multiple smaller ones; suddenly, you have one monthly payment to handle before you can rest easy at night.

You may not be able to group all your debts together, but that’s a question you should ask your financial institution. Further, it is important to avoid honeytraps by making sure it’s a suitable fit for you: is the new rate lower than the debts it covers? Is the monthly payment lower than the sum of your existing payments? Will you avoid taking on more loans after this one? These questions, on the other hand, are ones you should be asking yourself and your Family Wealth Advisor.

Eligibility for this option is dependent on several factors, such as your credit score or income level. It is important to understand all the options available to you. Lenders are anything but few and far between, and almost all of them want your business. Thanks to the competitive nature of the loan industry, you can shop around to find the best fit for both you and your budget.

A word of caution, however: you may want to avoid applying for a baker’s dozen of loans with different institutions in quick succession and incurring hard credit checks (which appear on your credit report), as it may lower your credit score altogether. This is known as credit-seeking activity in the eyes of lenders. For better risk management on their end, they often err on the side of caution as to whether you are simply looking for the best offer or if you plan on accepting every offer and being unable to honour each of them. This situation may effectively mark you as a high-risk borrower and send your income-to-debt ratio plummeting. If possible, inquire if the lender is conducting a soft credit check, which does not impact your overall credit score.

How Else Can I Better Manage Debt?

Realistically, there isn’t a magic formula that works for everyone across the board—our job is to find the one that fits your needs. You could very well idealize a certain approach, but your neighbour might favour a different path. It all depends on the circumstances and how the interest rates and total balances interact with one another. Thankfully, a Bellwether Family Wealth Advisor can help you figure out which portions of which strategies will best suit your situation. It ultimately comes down to figuring out which loans will be most costly over an extended period and discussing the best path forward.

Once you’re back on track and your income-to-debt ratio is where you want it to be, it’s important to learn from the experience and better situate yourself for the future. The landscape of the loan markets is ever-shifting, and adjusting alongside them is just as important as seeing the shifts themselves. As one final piece of advice, not all debts are created equal; some can have more (or less) of an impact on your credit score. The question is, which ones are they?

Find out with one of our seasoned experts.