Few of us test our powers of deduction, except when filling out an income tax form.

– Laurence J. Peter

Known primarily for his development of the Peter Principle, the Vancouver-born writer shares a valuable insight into the average citizen’s actions during tax filing season. Given that, he may be forgetting how busy Canadians are. Taxes can be stressful, time-consuming, and ultimately confusing for most… but they don’t have to be. Here’s a series of questions that many clients ask, and we’ve compiled them into a checklist for your benefit.

When is the 2023 Tax Filing Deadline in Canada?

The deadline for employed Canadians to file their personal taxes typically lands on April 30th for any given year. If that date falls on a weekend, however, it is pushed to the next business day. Looking towards 2023 as an example, where April 30th calls Sunday its home, the deadline has been reassigned to May 1st.

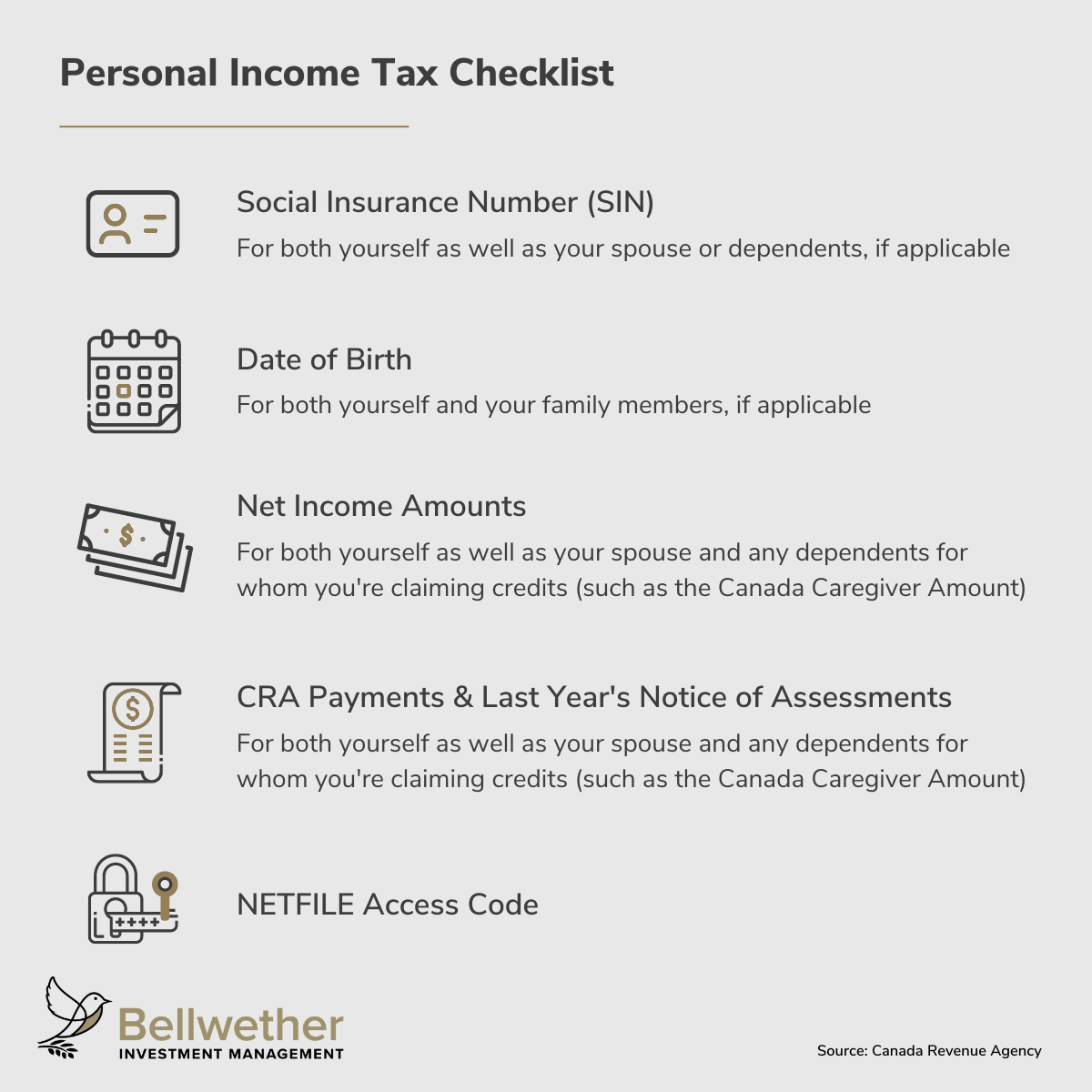

What Personal Information Do I Need to File My Taxes?

While taxes are usually different from one person to the next, there are a handful of necessities that apply to almost everyone. Here’s a quick overview of what you should have ready when you sit down with your paperwork:

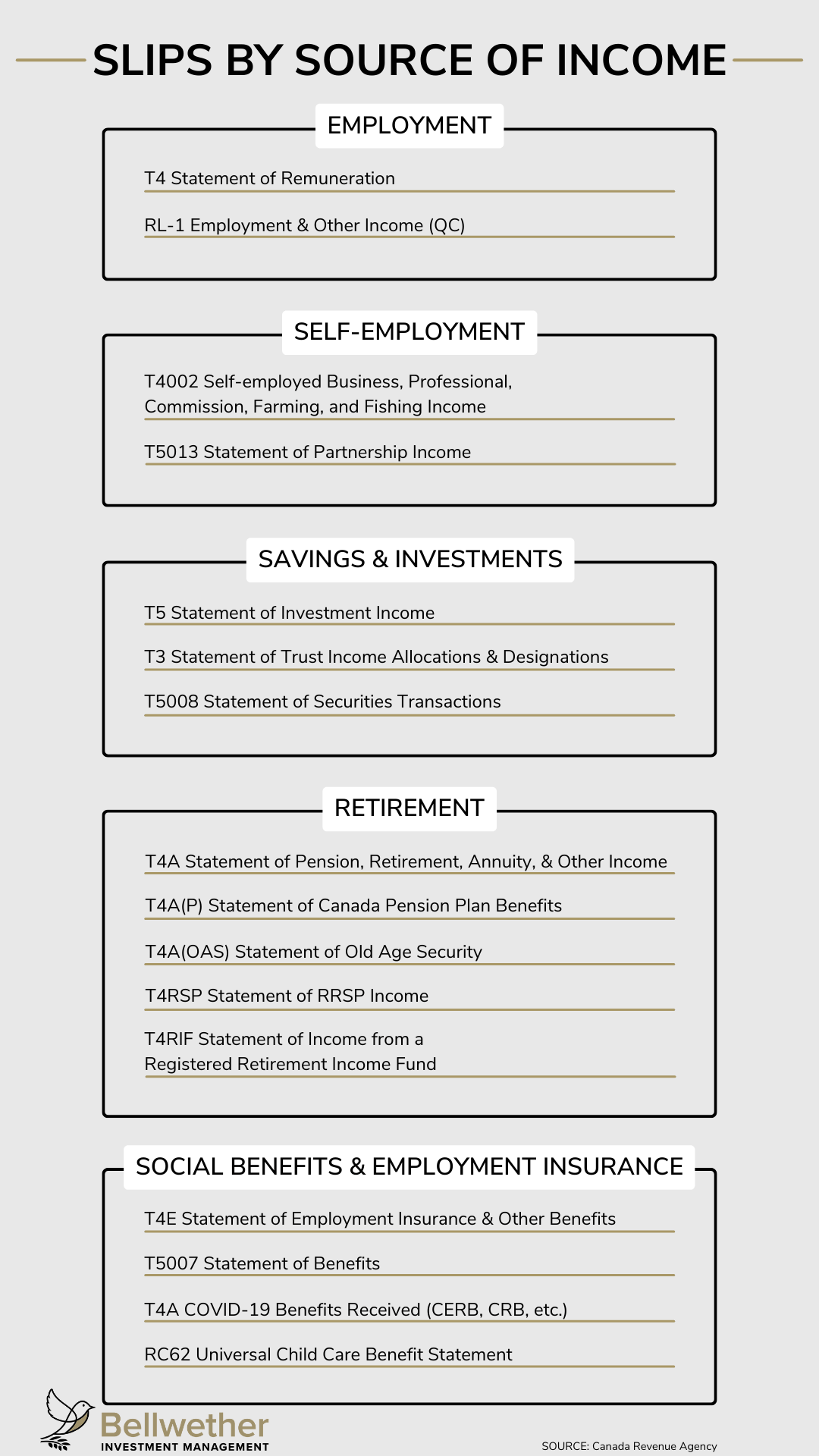

What Income Slips Do I Need to File My Taxes?

It’s important to know which specific income slips you’ll need to file given your situation and sources of income. Looking at a sample list of some of the various forms, however, can be intimidating. With over a dozen various documents you can possibly file for your 2022 taxes, not all of them are applicable to everyone. Separating them into baskets to know which ones you’ll be needing may help clarify which slips pertain to your situation:

While we don’t expect everyone to have a list on hand (although you now know where to find one) the two major groupings are T4 and T5 slips for most employed investors. The former typically covers sources of income such as salaries or pension income, whereas the latter is usually geared towards investment-based income. Of course, the subcategories within these groupings are more focused and specific to the type of income generated.

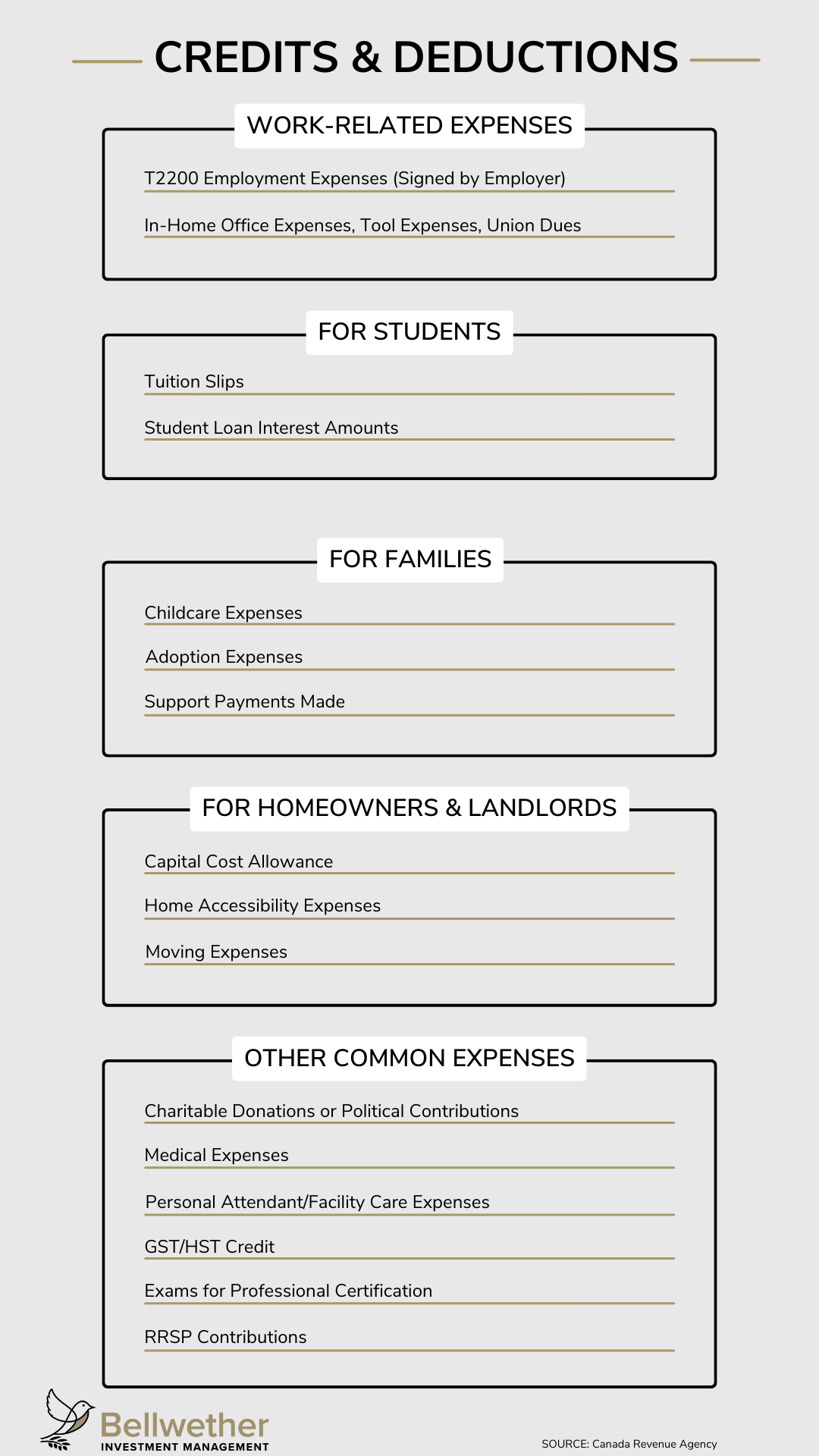

What Eligible Deductions and Tax Credits Can I Use for my Taxes?

Credits and deductions can make all the difference for your finances and help you keep more of what you earn. While we’ve already written about tax-efficient investments in a previous article, a shortlist of other options that may benefit you this tax season includes:

How Do My RRSP Contributions Impact My Taxes?

As seen in the credits and deductions graphic above, we saved the best for last: RRSP contributions can have a significant positive impact on your filing as they reduce your overall taxable income for the year. The tax you defer upon contribution, however, is just that: deferred. When it comes time to withdraw, the funds will be fully taxed at your marginal rate. The reigning school of thought is that you should contribute during your working years when you are in a higher tax bracket and withdraw when you retire and your marginal tax rate is lower.

Many will encourage you to max out your contributions annually and without fail, but under certain circumstances, different strategies can benefit you. As per usual, a one-size-fits-all approach is rarely applicable in the world of personal finance and investment management.

Hypothetically, if you are scaling your business or your investments are maturing and you expect your income to be significantly higher in the future, you can decide to forego putting money into your RRSP and instead opt to build up your contribution limit, as any unused room can be carried forward indefinitely. Then, when your business is operating much more profitably, or you realize significant capital gains, you can make the appropriate contributions to effectively offset the taxable income. This technique has been well received by our clients once their financial plans come together.

How Do Capital Gains and Losses Work for My Taxes?

As investors, depreciating assets are rarely the ideal outcome—but these inevitabilities can be useful when it comes time to file your Schedule 3. For example, if you were to purchase a security and sell it once it has fallen in value, you are able to apply your capital losses against your capital gains in other investments and reduce your overall amount owed.

In another scenario, if your losses exceed your gains for that year, you may not be the most excited. But again, there is a silver lining. While you cannot apply your capital losses to other sources of income, they do become an aspect of your net capital loss and can be applied as a deduction against taxable capital gains in any future year, or even carried back and applied against previously recognized capital gains in the prior three tax years.

Chris Jardine, a Bellwether Family Wealth Advisor, also notes the importance of non-capital losses. In the scenario where you have “recently started a new business, or perhaps have invested a tidy sum into your existing business, you may have non-capital losses—in simple terms, your expenses exceeded business income.” Again, this may not be ideal, but he suggests that clients “don’t just file the return and forget about it. Instead, you will want to figure out which year you can use this loss to decrease your income tax bill.” Like capital losses, they can be “carried back three years” but carried forward only up to 20 years.

How Does Filing My Taxes Change from Year to Year?

Every year presents new opportunities, as Jardine mentions. “One that clients may not be thinking about is the Ontario Staycation Tax Credit, where you can claim 20% of your eligible accommodation expenses up to $1,000 for individuals and $2,000 for families—potentially $400 in tax savings because you went on a summer vacation last year.”

Staying on top of these changes from year to year can help you know that your taxes are being filed with a higher likelihood of seeing the outcome you want: owing less.

Although we suggest consistently being on the lookout for changes to the rules and regulations that may impact your tax filing process, that may be a little unrealistic given your busy schedule—not to mention that’s what you have us for.

A good rule of thumb is to keep track of when there’s a change in provincial or federal leadership. For example, after Doug Ford was elected as Ontario’s Premier in 2018, the Low-income Individuals and Families Tax (LIFT) Credit was introduced just a year later in 2019. The LIFT Credit resulted in no provincial income taxes payable by those earning less than $30,000 and whose family income is less than $60,000. These thresholds have since been changed to $50,000 and $82,000, respectively.

Can I File My Taxes Electronically?

Thanks to the Canada Revenue Agency’s (CRA) NETFILE system, Canadians can now file their taxes much more easily and efficiently than through registered mail. Understandably, some who are less tech-savvy may find this option somewhat intimidating, but at the end of the day, the CRA has made the process easy for everyone from Zoomers to Boomers. If you can attach a work file to an email, you can probably utilize NETFILE with ease. Furthermore, the CRA prides itself on its top-of-the-line encryption service, so you can rest easy knowing your information is safe from prying eyes.

There are several benefits to filing online. Confirmation emails are sent almost instantly and alert you if everything is above board or if adjustments need to be made, which would take days or weeks with more traditional mail-in attempts. More excitingly, however, is that NETFILE uses direct deposit, which can land in your account within two business weeks, as opposed to the four to eight weeks you may have to wait for a paper copy to come back. File faster, finish faster, and refund faster.

There are a handful of limitations. If you’d like to read more and see if you’re eligible, read the NETFILE restriction list here.

Should I Keep Copies of My Tax Returns or Supporting Documents?

Unequivocally yes. Whether or not the reality of being audited is likely for you, being ready for the possibility is much easier than dealing with the fallout of being caught unprepared to handle it. While the CRA can usually (in rare, extreme cases such as suspected fraud, they can go as far back as their discretion warrants) only conduct an audit up to four years after a tax return has been filed, they maintain their records for six years. As such, a good time to hold onto your documents is six years, if not longer.

Who Can Help with My Taxes?

With a Bellwether Family Wealth Advisor, you can set up a financial plan to stay ahead of the curve and plan your finances accordingly for when it comes time to file your taxes. Our experienced team can introduce you to their network of professionals and put you in contact with expert tax specialists or accountants, so you don’t have to do the shopping around.

In his closing remarks, Jardine mentions one last sliver of information, reminding clients to “report their investment management fees on their non-registered accounts from Bellwether as they qualify as a tax deduction as well.”

If even our fees have benefits, just imagine what our service can do for you and your family.