“Canada has a productivity issue and it has a competitiveness issue.”

— Brian Porter

U.S. markets have continued to exceed expectations, leaving Canadians enviously watching as domestic investment opportunities struggle to find their footing. As we outlined in a recent article, home-bias investing can dampen portfolio performance.

The question for today, however, is simple—what’s holding Canada’s stock market back?

Overconcentration vs. Diversification

We could spend weeks prying into individual businesses, but the problem facing the Canadian market is bigger than any single corporation—the nation is overleveraged to stocks related to banks and natural resources.

Overconcentration, the opposite of diversification, is rarely a good thing, and our markets are not the only ones with this habit. Across the border, technology and healthcare dominate the U.S. markets.

If both sides are guilty, how come one is significantly lagging behind the other?

Boring Stocks, Exciting Stocks—They're Still Stocks

As we’re sure you’ve heard, artificial intelligence has dominated the conversation lately. “This company exports petroleum” just doesn’t have the same allure as “this software will change the world while doing your homework for you,” sadly.

We can categorize them as “new” and “old” economies. The S&P 500 likes the new, shiny products hitting the shelves, with 43% of its weight going towards technology and healthcare. Comparatively, these sectors only make up 9% of the S&P/TSX, which is dwarfed by financials and energy, which claim 48% of the index.

Boring, exciting, old, new—these are all just words. In more technical terms, the S&P 500 leans towards growth companies, and the composite index finds itself more at home with cyclical/value stocks. Like any well-managed portfolio, however, there’s room for both.

Explaining Divergences

Understanding the key differences may help us glean some insights and potential lessons, as reported by The Financial Post:

-

The S&P/TSX composite does have technology sector exposure. It’s even outperformed its S&P 500 counterpart (+106% and 83% since October 2022, respectively), but due to its much smaller weight, it has not been able to keep up with the American market.

-

“New” and exciting companies like Alphabet Inc. and Meta Platforms Inc. call the U.S. home, whereas Canada hosts “old” communications companies like Rogers Communications Inc. and others. The growth trajectory for this older corporation is significantly lower than that of the likes of Google or Facebook.

-

Materials also made a significant impact. Canada prioritizes metals and mining, both of which are negatively impacted by slow global growth. The S&P 500, however, has a wealth of chemical companies that aren’t as reliant on global economic health.

Does That Make Growth Stocks Better?

-

Growth stocks: companies that are expected to increase sales and earnings at a significantly higher rate than market averages. Value is often speculative, based on promises of future performance.

-

Value stocks: companies trading at lower prices than their underlying fundamentals would suggest. Mature companies with a history of stable dividend distributions often fall into this category when experiencing adverse events.

Yes and no—it’s all relative, and there are several layers to peel back. They are experiencing higher capital appreciation in the current environment, but that could shift at a moment’s notice, and value stocks could come back into favour. In fact, value stocks have outperformed growth stocks by 4.4% annually since 1927.

To complicate matters further, growth investors tend to have one opportunity to turn a profit—selling the underlying asset for capital gains. In contrast, value stocks with a strong track record of growing their dividends provide investors with regular returns as well as the possibility for capital gains later down the line.

Our Approach

The Canadian stock market is struggling, yes, but that doesn’t mean there aren’t opportunities if you know where to look. As mentioned earlier, our technology sector is outperforming its American counterpart. Picking stocks can be difficult, risky, time-consuming, and unnerving for one person, but our investment management team holds regular meetings with portfolio managers across North America to discuss the latest developments and potential moves to be made.

Collectively, they have over a century of industry experience. As discretionary managers, this translates into actively managing client portfolios to better navigate risks and capture returns. Coupled with our fiduciary responsibility, we never put anything but their needs first. It’s a good arrangement.

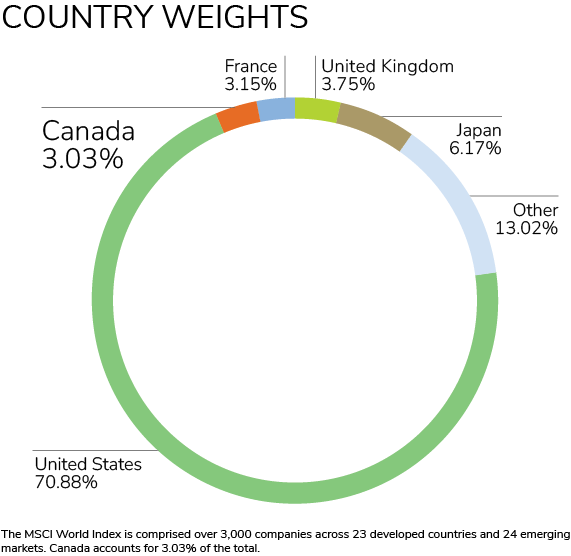

That being said, if you know where to look, then you also know there’s a world of opportunities beyond our borders. Home bias investing, at its most logical level, exists for a reason—you know the company you’re investing in; you shop there on weekends; you can see how their business is going right in front of you. But if you stick to what’s comfortable, familiar, and Canadian, you’re missing out on… a lot.

That century of collective experience allows us to do what many can’t—strategize globally. In doing so, we not only diversify client portfolios to better mitigate volatility but also find exciting investment opportunities that they’d otherwise be unaware of.

Regarding growth versus value stocks, debating which of the two is inherently better is like chasing shadows in the night. Both have their place, and they will shine at different times. Our approach is to hold both for their advantages and, more importantly, help offset one another’s shortcomings.

Growth stocks, as we’ve outlined, risk relying on share value appreciation to generate returns. An allocation to value stocks, then, can serve as effective risk mitigation by selecting dividend-growth companies. While you wait for that big jump from a tech stock promising the future is now, your dividends will continue paying you, which can either be reinvested or used for income needs.

The fact of the matter is that growth stocks are leading global markets, and while we’ve certainly benefited from our positions in the Magnificent 7, it’s unrealistic to assume that it will stay this way forever. A well-managed portfolio takes advantage of the current environment and is prepared for when the next stage of the market cycle materializes.

Yes, Canada’s sector concentration is an issue right now. Under the current circumstances, this is by design. But here’s the crux of the matter—once the market environment pivots to a more favourable value/pro-cyclical atmosphere (ex. swelling global economic growth and trade), the script will likely flip, shoring up the very sectors that are holding back our growth profile.

And once it does, we'll be ready to take advantage of the opportunity on behalf of our clients. In fact, we already are.

Next Previous