“Planning is bringing the future into the present so you can do something about it now” — Alan Lakein

As an expert on personal time management, Lakein’s outlook was so influential that former U.S. president Bill Clinton even opened his autobiography with a nod to the American author.

If the old saying that time is money rings true, we’ve put the time in and invested in building a team-oriented organization that enriches advisors’ businesses. Here’s how we not only enable growth but, more importantly, the freedom to enjoy it.

The Origin Story

As the world of financial services continues to evolve, regulatory requirements grow, and demand for better client service rises, advisors hoping to stay competitive are forced to wear too many hats.

It’s just not efficient—if you’re preoccupied with portfolio management, financial plans may start being treated as an afterthought. Worse yet, once your time is stretched even thinner with all the other responsibilities of being an advisor, the clients may feel neglected.

As a client-centric firm, it’s something we’ve strived to eliminate from the equation by developing a collaborative framework where everyone does what they excel at.

Who Does What?

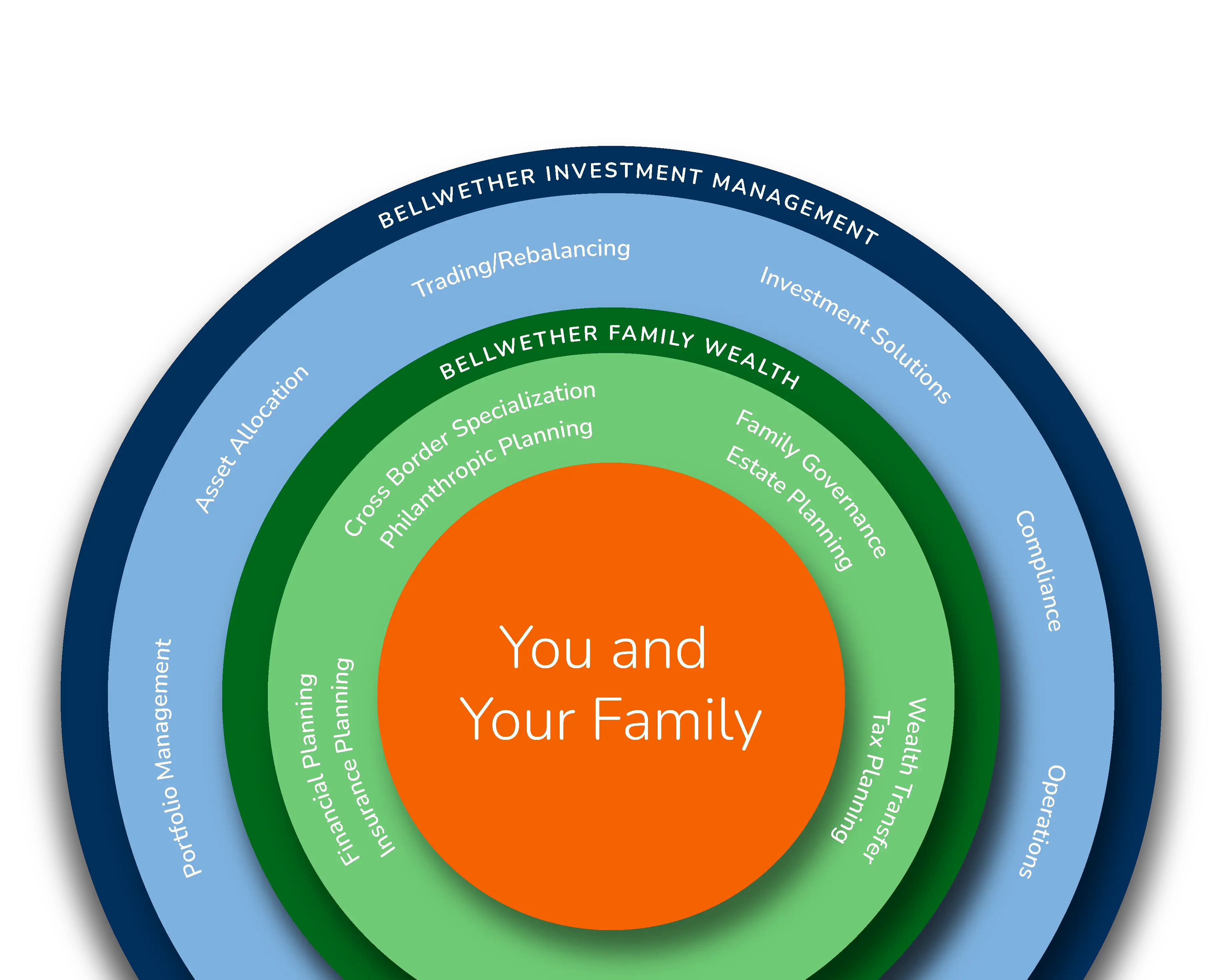

Everything ultimately comes back to the client experience. Bellwether Investment Management looks after portfolios so Family Wealth Advisors can look after their clients.

Why Advisors Choose Bellwether

There are more reasons than we have room to list here, but there are a few key points that advisors consider when choosing Bellwether.

Client First, Redefined

As fiduciaries, we’re obligated to always work in our clients’ best interests. This means avoiding conflicts of interest and consistently putting their needs ahead of our personal gain. Beyond these expectations, we also oversee portfolio and regulatory processes to give that time back to advisors. When their focus is squarely on managing client relationships and expectations, planning for the future becomes much more effective—if your circumstances change, they’ll be ready to adjust accordingly and get you back on track.

Discretionary Management

With discretionary management, client portfolios can be adjusted without the need to contact them every time a transaction is about to be made. This comes with significant benefits, such as faster response times to changing market conditions and keeping portfolios nimble enough to take advantage of emerging opportunities while avoiding unnecessary risk. Clients can rest easy knowing that experienced professionals in the field are monitoring and managing their portfolios through proven, repeatable investment processes.

Independent & Supportive

With dedicated compliance specialists and other support teams at their disposal, advisors can simplify their regulatory processes and free up time for identifying new prospects or deepening existing client relationships. More generally, it allows advisors to focus on whatever their specific goal is and how Bellwether can help them achieve it.

Sustainable Growth

Our in-house marketing department can leverage brand recognition, accomplishments, analytics, content, and personalized collateral to help find new leads for advisors looking to grow. Sustainable growth shouldn’t sacrifice the quality of service advisors can provide to existing or future clients. For our partners, it doesn’t have to—advisors have seen their books grow since joining Bellwether.

Succession Planning

Building a successful business is no easy task, but neither is finding a successor when the time comes. We understand that it’s a major decision that can impact advisors and clients. Whether it’s a service disruption during a shaky transition or a mismatch between the successor and the clients, choosing the right person to carry the torch is vital for your legacy. Thankfully, our unique model means advisors nearing retirement don’t have to worry about making this choice themselves. Whether they choose to nominate their own or let Bellwether purchase the book in full, we believe that the best transition for clients is one that seems like it didn’t occur at all.

The Future of Financial Services

Advisors change lives every day, and we’re here to return the favour through our dedicated team of specialists. By relieving them of their burdens, they can focus squarely on pursuing what brought them into the industry in the first place: helping others achieve their dreams.

Together, we infuse excitement into their business, making the journey as rewarding as reaching their goals. To find out more about a possible partnership, or if you’re looking to make being an advisor fun again, contact Georges Nasr at georges.nasr@bellvest.ca or 905-337-2227, extension 231.

Next Previous