“No product is more central to international trade than semiconductors."

– Chris Miller

Miller puts semiconductor supremacy under the spotlight of the geopolitical stage, providing a compelling argument as to why exactly this technology is vital for the world economy. Let’s unpack a few of our own thoughts on how a product measured in nanometers can have massive impacts on global trade. After all, Chip War: The Fight for the World’s Most Critical Technology won The Financial Times Business Book of the Year in 2022 for a reason.

What Are Semiconductors Chips?

Often referred to as semis or chips, these products are named after their conductivity, which lies somewhere between insulators (like rubber) and conductors (such as copper). Although usually made of crystalline silicon or germanium with integrated circuits, impurities can be introduced to create compounds that have different properties through a process called doping.

How Are Semiconductors Made?

By stacking thin wafers of interconnected semiconductors with extreme attention to detail, working microchips are made. Advanced chips can have up to 100 layers and require extreme ultraviolet (EUV) or deep ultraviolet (DUV) machines to etch circuits that are smaller than a human blood cell.

Competition between manufacturers is fierce, with the mantra of “faster, smaller, and cheaper” driving innovation.

Why Are Semiconductors Important?

They are found in virtually every electronic device you’ve used, seen, or heard of because of their knack for managing electrical currents. From the mundane, like smartphones and home appliances, to advanced military weaponry and artificial intelligence (AI), semiconductors have a place at the table.

As “dual-use” products with commercial and military applicability, semiconductor supremacy is presented as a concern for national security and economic prosperity. This duality has become central to decaying Sino-American relations.

Chip Supremacy or Self-Sufficiency?

In anticipation of international trade winding down, global superpowers have not been shy about securing their own means of production. As the two largest economies, China and the U.S., move towards self-sufficiency, some are concerned about how deglobalization may impact global markets.

In May 2019, Warren Buffett warned that trade erosion between the two countries would be “bad for the whole world.” Four years later, in May 2023, at the annual Berkshire Hathaway shareholders event, he reaffirmed his stance and asked that both parties “understand the game and understand that you can’t push too hard,” arguing for diplomatic relations where both can “be competitive and both can prosper.”

Even if the 92-year-old may be biased towards open, healthy trade, action taken by world governments suggests that if the battle for oil dominated the 20th century, semiconductor production may become the face of the modern era.

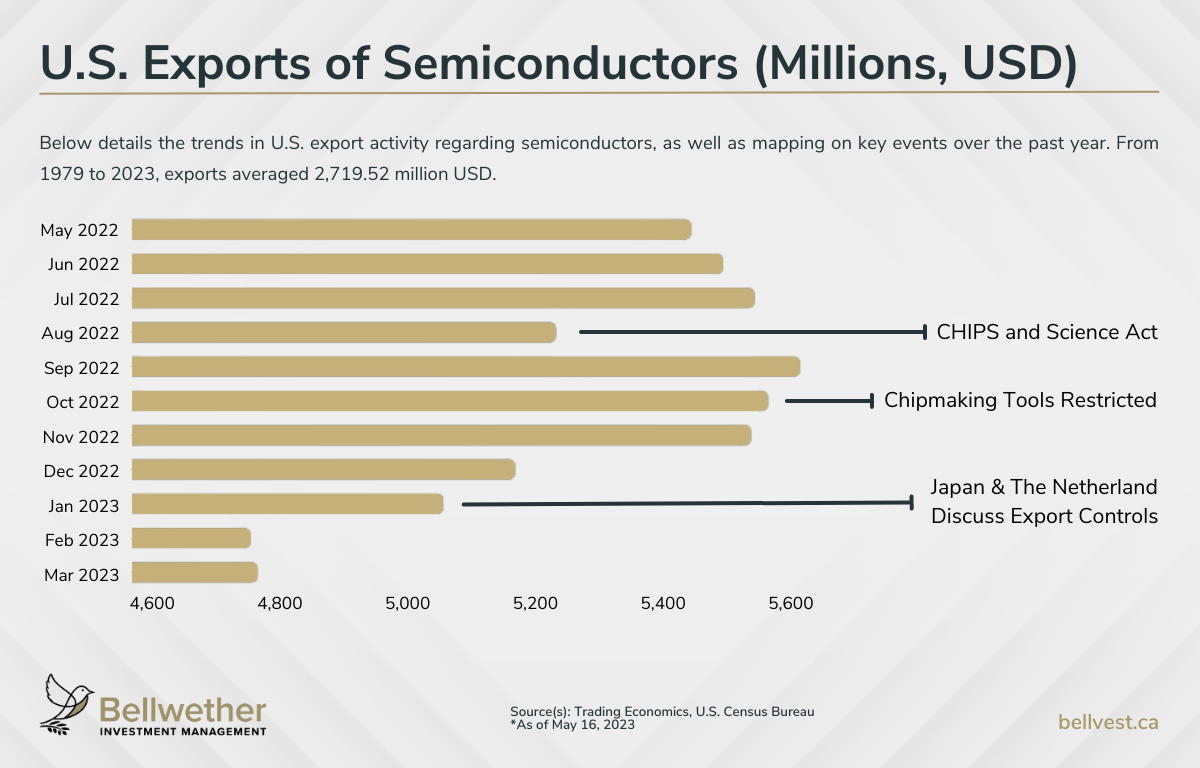

The CHIPS and Science Act received a rare showing of bipartisan support in August 2022. The law is designed to boost U.S. competitiveness, supply chains, innovation, national security, and production capacity by directing over $250 billion in funding, subsidies, and direct investment. Although broad in its design, $52.7 billion alone is earmarked for semiconductor R&D, manufacturing, and workforce development.

In October 2022, the U.S. Department of Commerce attempted to hamper Beijing’s progress by restricting exports of chipmaking tools. In January 2023, Japan and the Netherlands joined the cause for new semiconductor export controls. Although the exact details are likely to remain under wraps until the two governments publish their own export regulation updates, clues are available.

The move from unilateral to multilateral restrictions requires that we consider the process entirely and who the key players are. To not bore the reader, there are three broad categories: design, fabrication, and assembly and testing. Within each category are a slew of technologies, intellectual property, licensing, software, and more.

Each of these stations can create a chokepoint for Chinese chip production, and the United States is currently the dominant supplier in most of them. Where they lack is where Japanese and Dutch companies excel as "exclusive providers of advanced photolithography equipment" such as EUV machines and ArF scanners, according to a report from the Centre for Security and Emerging Technology.

What’s China’s biggest chokepoint for cutting-edge semiconductor production? This very same equipment in the hands of ASML and Nikon, which are now slated to align themselves with American restrictions. Tian Jian, Chinese ambassador to the Netherlands, told a Dutch newspaper that “if damage occurs, we must take action to protect ourselves,” adding that “it won’t just be harsh words.”

We acknowledge that this could mean any number of things. It could range from leveraging their EV battery production and restricting access to the West to stepping further away from technological dependency. Whatever the case, markets are likely to feel waves from across the Pacific.

How Markets Could Be Impacted

It remains to be seen if the “dual-use” of Advanced Technology Products (ATP) like chips is primarily a national security concern. The perceived risk may be inflated to cover the commercial side of semiconductor dominance.

While we are not privy to the Pentagon’s inner council, we do have access to our own team of financial experts and analysts. So, let’s stick to what we know.

Although they are efficient and lend themselves well to growth, the pandemic reminded us just how fragile global supply chains can be. They tend to centralize issues, such as Europe’s dependence on Russian natural gas or the global need for Taiwan’s semiconductors. These economic issues often act as staging grounds for geopolitical relations.

One issue to consider is how trade restrictions placed on ATP may impact exports, which could harm revenue and growth. With Japan and the Netherlands behind them, we can expect the States to feel emboldened enough to tighten control further and cause exports to fall dramatically.

As Beijing and Washington reconsider their relationship with globalization, a decoupling between the two economies could temper corporate earnings. Even with significant subsidies for semiconductor production in the States, development and operational costs are substantial. According to a report from the Semiconductor Industry Association, the “ten-year total cost of ownership of a new [facility] located in the U.S. is approximately 30% higher than in Taiwan, South Korea, or Singapore, and 37% to 50% higher than in China,” which is “an enormous gap considering that the ten-year cost … including initial investment and annual operating costs, ranges between $10 billion and $40 billion.”

Although government subsidies may help soften the blow on these big-ticket items, they won’t cover them entirely. Given that the difference must be made up somewhere, we can reasonably assume that capital expenditures (CapEx) will increase over the coming industrialization of homegrown American semiconductors. Some players, like Micron, have already made commitments as high as $100 billion.

Operational expenditures (OpEx) may increase as well due to increased average American wages, but the government and corporations are keen on reshoring jobs. According to a report, American corporations announced 105,000 EV battery positions and 28,800 semiconductor jobs in 2022 alone—both of which set new records.

What’s Next?

With Taiwan still central to Sino-American relations as a strategic nation for commercial and military reasons, the situation remains volatile. Legislation with the potential for economic consequences (good or bad) could be introduced at a moment’s notice; examples such as Senate Majority Leader Chuck Schumer’s new initiative to pass a China Competition Bill 2.0 or China’s biggest financial data provider limiting offshore access come to mind.

It's likely that increased CapEx and OpEx coupled with reduced exports could make the short- to medium-term outlook difficult for semiconductor companies in America. Over the long-term, this sort of industrial renaissance may create start-to-finish domestic production efficiencies that could synergize well with future foreign and domestic investment. Securing national production and supply chains comes at a cost, but considering how prevalent semiconductors are in electric products, these costs are most likely to flow through to corporations and consumers.

Despite trading tensions, 2022 marked the highest-ever annual increase ($574.1 billion, +3.3% compared to 2021) in global semiconductor sales. With the rise of AI, the automotive industry, smartphones, and the overall growth of everyday technology, demand is unlikely to slow down anytime soon. Simply put, supply needs to catch up.

Change is always on the horizon, and this isn’t something to be afraid of. It’s something to be educated on that can bring opportunity to those who are appropriately prepared. Why not prepare with us?

Next Previous