"Innovation distinguishes a leader and a follower." – Steve Jobs

For the sake of honesty, Bellwether is not an industry titan. They do not have millions of clients, thousands of employees, or hundreds of branches.

But this is by design, and they use it to their advantage. While they may not operate on the same scale as a bank, they more than make up for it in experience, discipline, and, above all else, client protection. One of Bellwether’s mandates as Portfolio Managers is to consistently innovate new defensive measures to prudently grow your hard-earned capital. Affluent families across Canada and the United States have distinct requirements from their advisors; it only makes sense for them to meet, and often exceed, those needs.

Here’s how Bellwether can grow your portfolio, bring you closer to your financial goals, and avoid unnecessary risk along the way.

Disciplined, Seasoned Experts

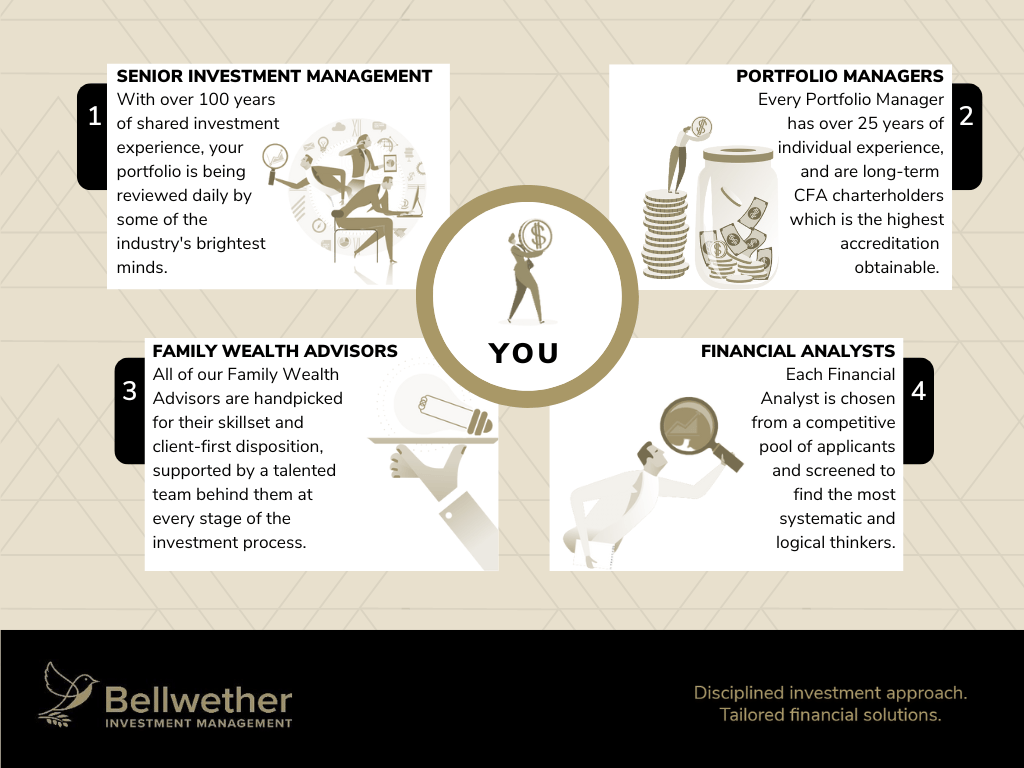

One of its greatest strengths lies in the experience of the team managing the firm. Even with a president and CEO that once headed Canada’s largest investment counsel, Bellwether recognizes that no captain can sail without a qualified crew. Each team member is an expert who thrives in their field because of this bottom-up approach to Bellwether’s collaborative, complementary hiring process.

So much so, in fact, that it has been recognized by the Canadian Business Journal, which remarked that each investment “team member has over 20 years of experience in the investment industry, and the team’s independence, agility and devotion to the distinct needs of affluent families provides a unique blend of skills and can-do attitude that work to their client’s benefit.”

A History of Growth and Success

Bellwether is a subsidiary company of Lorne Park Capital Partners Inc., a publicly traded company on the TSX Venture Exchange. Chief Financial Officer Carlo Pannella has played no small role in the company’s success. The executive states that “over the past seven years, our compound annual growth has been over 60%, leading us to $2 billion in assets under management.”

Pannella notes that Lorne Park “is a profitable company that has a history of increasing dividends to shareholders,” which is often a sign of strong leadership, a clear strategy, and a dedicated team. Adding to the company’s list of accolades, he mentions that they are “starting to see more attention, especially after we were honoured to be listed on The Globe and Mail’s list of Canada’s Top Growing Companies 2022 and The Financial Times’ list of The Americas’ Fastest Growing Companies 2022.”

How Fiduciaries Function

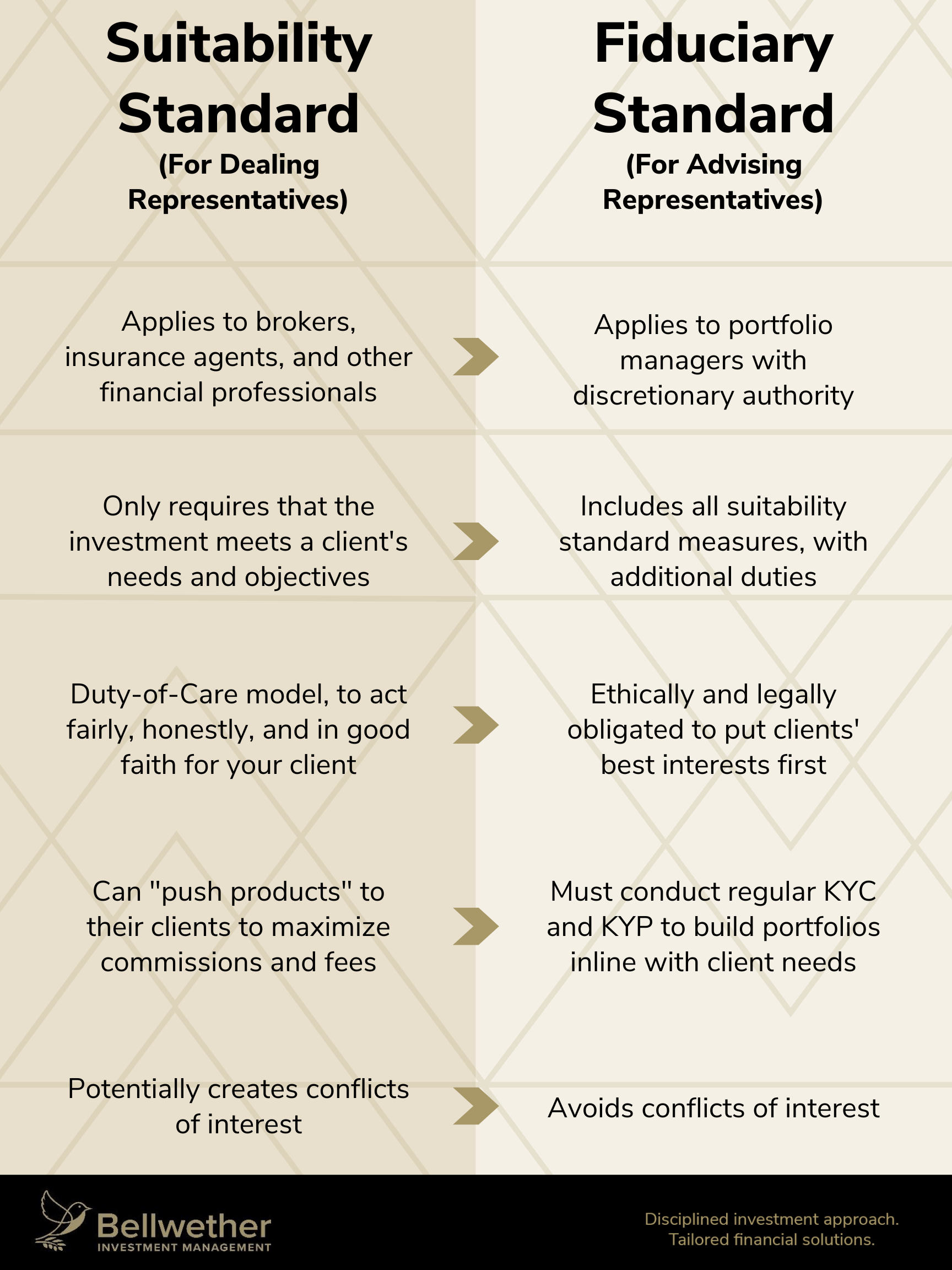

As registered Portfolio Managers, Bellwether is held to the fiduciary standard, the industry’s highest level of responsibility. Although the nuances are many, the key distinction to make note of is the concept of “discretionary investment management.” In essence, a fiduciary advisor can buy and sell securities at their own discretion but must do so by putting the client’s interests first.

The suitability standard, on the other hand, has much looser regulations in place; surprisingly, many financial advisors across Canada are only held to this standard.

Having this degree of control over client capital can be beneficial, ranging from the ability to move in and out of positions more efficiently to not having to constantly contact their clients for every transaction. To prevent bad actors from taking advantage of their privileges, discretionary investment management is only available to the most experienced professionals. Typically, these designations are reserved for Certified Investment Managers or Chartered Financial Analysts who have years of experience managing capital diligently.

Reputational Risk as a Motivator

According to Michael Ruck, a partner at the multinational law firm known as K&L Gates LLP, more than “60% of an organization’s market value [is] now attributable to reputation” in a world where technology has enabled consumer opinion to spread like wildfire. For already established financial institutions, protecting their reputation has suddenly become a priority. To sustain their reputation, many banks tend to favour protecting their image in the public eye and may end up making decisions that are less than optimal for the client. With their prominence and stature successfully built up, there doesn’t seem to be any rush to continue building.

Bellwether, on the other hand, is in the process of forming its own reputation as an alternative option for affluent families across North America and is differentiating itself along the way. Instead of exclusively protecting its brand perception at the cost of client service, the Family Wealth Management firm reverses the equation. By providing outstanding service, private investment opportunities, and repeatable, methodological wealth management practices, Bellwether is actively building its reputation with both the enthusiasm of a fresh business with something to prove and the conservative, balanced wisdom of banks with something to protect. A single misstep could spell disaster for their livelihoods, but this is not seen as a drawback. Rather, it’s considered the driving force behind an unwavering commitment to providing secure, reliable, and transparent service to clients.

The best form of distinction in the investment industry isn’t being grandfathered in based on a company’s age; it’s when a business actively improves its reputation at the most basic level by putting clients first.

Our Insurance Policies, Your Assurance

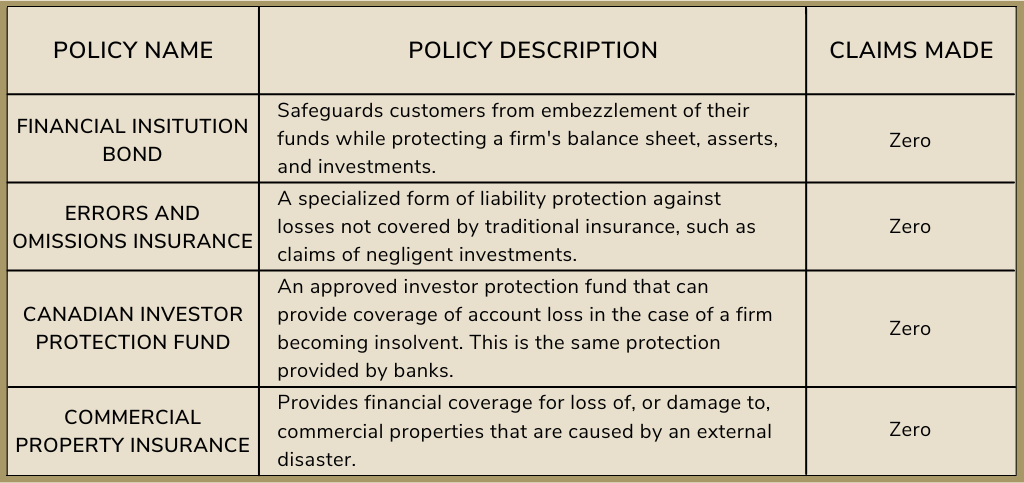

All investments and securities are held by third-party custodians, such as the National Bank of Canada and Fidelity Clearing Canada, which means capital is securely entrusted to an unbiased and accessible organization. Bellwether’s outlook hasn’t changed since it opened its doors: every entity that has a hand in portfolio management should work exclusively in the client’s best interest. Bellwether’s investment team of analysts, traders, and Family Wealth advisors works to grow your wealth, and custodians add another level of protection to that very wealth.

When asked about other protective measures in place, the CFO acknowledges that “beyond the use of custodial services, we have a comprehensive array of liability coverages to protect ourselves as a business, our advisors as professionals, and, principally, our clients.” He goes on to cite that there has never been a claim against these insurance policies since their inception. Crediting this achievement, Pannella gives a nod to Bellwether’s compliance department for “constantly adapting to the needs at hand.”

And for good reason, too. Chief Compliance Officer Julianna Varpalotai-Xavier discusses the importance of a forward-thinking mindset and notes that “with the ever-evolving nature of Canadian securities regulations, it’s been beneficial to stay ahead of the curve and look ahead—when changes are made, we adapt swiftly.”

The Right Fit for You

When asked about growth, Pannella proposed that “the value of sustainable, measured growth cannot be ignored.” In an industry known for sacrificing quality for the sake of quantity, Bellwether continues to strive to differentiate itself from bigger competitors.

Through impressive accreditations and established partnerships, Bellwether offers its clientele a suite of alternative and private investment products to better serve the specific needs of affluent families. Better yet, it does not come at the cost of losing that distinguishing factor: personal, tailored financial service. Advisors, analysts, and portfolio managers take on fewer clients so they can provide the best experience they can. If you need them, they are there without hesitation.

Bellwether never set out to be a massive financial institution. They are a reminder that you can treat clients like people, not numbers, and still have access to private, institutional-level investing opportunities. If you want to experience a new standard of service and security, book a free portfolio review today.

Next Previous