“We should remember that good fortune often happens when opportunity meets with preparation.” – Thomas A. Edison

The popularity of alternative investments has recently experienced a meteoric rise. While traditional investments such as stocks and bonds have their place in a diversified portfolio, more investors are turning to alternatives to more fully diversify their holdings, reduce risk, and potentially generate higher returns.

But what exactly are alternative assets, and why should more people consider them?

What Are Alternative Investments?

Stocks, bonds, and cash have a long history as the underlying foundation of portfolios. While they aren’t going away any time soon, additional opportunities must be considered to help offset their dampened returns in recent years.

Private equity, hedge funds, infrastructure, real estate, and even high-end collectibles all fall into this exciting field of assets. Jeff Black, a Bellwether portfolio manager with over 30 years of industry experience, sums it up tidily by acknowledging that "alternatives are often private compared to traditional stocks and bonds, which are predominately public."

What Are the Benefits of Alternative Investments?

Aside from what looks to be an opportunity for massive growth in the alternative investment market, hedging against inflation, and portfolio diversification, one of the most attractive aspects of these assets is their low correlation to public markets.

Black puts forward the notion that "alternatives can be, in many cases, less correlated to the other holdings in a portfolio and hence not subject to the same external influences," such as interest rates and other catalysts. “The fact that many alternatives are not ‘marked to market’ daily like public exchange vehicles can be of psychological benefit to investors," positing that "less volatility and measurement can optically be a plus for those who may fret otherwise or worry prematurely—sometimes in investing, the adage of ‘out of sight, out of mind’ holds true."

Taking these together, it’s not that alternatives will necessarily generate higher returns without fail, but rather that they can play a pivotal role in diversification. In a well-constructed portfolio, it is clear how each investment can play to its strengths and fill in the gaps where other assets may be lacking. For example, if the stock market is performing poorly, an investment in infrastructure or real estate may still generate positive returns during the downturn, creating a buffer against losses.

What Are the Disadvantages of Alternative Investments?

While alternative assets undoubtedly provide numerous advantages, no investment is perfect or risk-free.

By their nature, many alternatives are less liquid; unlike a publicly traded stock that can be sold with relative ease, it is much harder to do so for rare pieces of art. Another issue that should be addressed is the higher fees commonly associated with this asset class, which are largely due to its complexities. In most cases, the financial barriers to entry into alternative investments are insurmountable for many people and are often only available to accredited investors.

One misconception regarding alternatives is that they fall into a regulatory grey area, which tends to make investors uneasy. While some of the more esoteric options (such as fine art) may be subject to different rules, many managers in the alternative spaces are registered with the SEC in the US or a provincial securities commission in Canada.

Still, it can be difficult to conduct research without the proper tools. Black states that "proper due diligence must be performed and conveyed" to allay investors’ lack of knowledge and legitimate concerns. Crediting Bellwether, he is thankful for the "strong internal due diligence process that determines opportunities via quality managers" with the resources and expertise to "focus on a variety of unique strategies in the realm of alternatives."

.webp?width=1728&height=2304&name=Pros%20and%20Cons%20of%20Alt%20Investments%202%20(1).webp)

Why Are Investors Excited About Alternative Investments?

According to a previous report put forward by Preqin, this growing asset class is forecasted to hit $23.21 trillion by 2026 in global assets under management (AUM). To put this in perspective, that nearly doubles the estimated value of $13.32 trillion at the end of 2021.

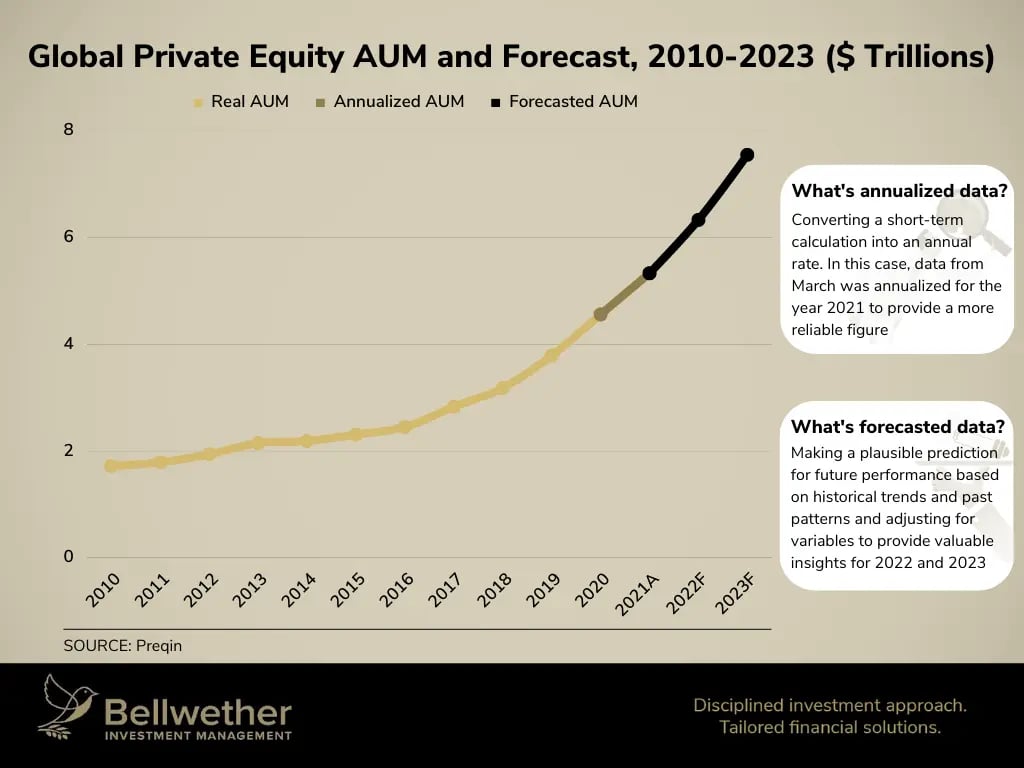

Looking at private equity as an example, the growth of this subcategory speaks to how managers are adapting to the new landscape of the investment world.

But private equity is only one of many alternative assets available to investors, and it may be the most saturated. Other key findings from the Future of Alternatives 2027 report include different subcategories to pay attention to. Globally, venture capital is shaping up to be the fastest growing with 19.1% annual growth, followed by infrastructure and private debt with 13.3% and 10.8%, respectively.

What’s the Bellwether Difference?

Even in the world of alternatives, it pays to diversify your holdings to produce a more resilient portfolio. Bellwether’s investment strategies and proprietary pooled funds are designed to withstand market volatility; alternative lending, real estate, and infrastructure have been bright spots in an otherwise gloomy market.

Like a bond, the initial loan from private lending arrangements is paid back at the end of the term, and interest is paid in the meantime. Unlike a bond, however, there is the potential for higher returns with built-in inflation protection because these loans are often short-term and/or adjust up and down based on a reference interest rate. An easy way to think about private lending is as an alternative form of fixed income with several benefits in a high-inflation, high interest rate environment.

In fact, the recent weakening of the global economy is an effective accelerant for the growth of private lending. Barring the possibility of defaults or loan delinquencies, private lending returns are often in lockstep with interest rate changes. This added safety allows investors to worry less about the health of the economy and focus on the well-being of their finances.

Infrastructure and real estate, another cornerstone of Bellwether’s strategy, are chosen for their endurance: everyone needs a home to sleep in, highways to drive on, ferries to cross waters with, and energy production to power their grids. Black makes an apt comparison in saying that they behave "quite like utilities; the demand cycles are constant and tend to be steady over the long term."

This class of alternatives is valuable for the shelter (and positive returns) it provides investors while the storm passes overhead, and surely, the skies are clouding over. Recent global events have presented the opportunity for infrastructure to perform well over the coming years. European projects are expected to lead the charge as they move towards addressing an energy crunch and their overdependence on Russian supplies.

Ultimately, private equity can be a lucrative endeavour, but when it comes to risk aversion, there may be better-suited alternatives. In uncertain times, it is wise to prioritize finding stable ground known for reliability and durability. As an effective hedge against the market’s shifting tides, the advantages of debt capital should not be overlooked. Bellwether’s Alternative Income fund, for example, has managed to generate positive returns throughout 2022, even during the deepest reds.

But this isn’t by chance, as Bellwether has been concerned about the potential for an upward shift in interest rates for years and has devoted significant resources into developing a solution to this problem—and it has certainly paid off. The senior investment team’s strategic foresight into worsening economic conditions has proven again that proactive measures are better than reactive adjustments.

Why Aren’t More People Investing in Alternatives?

A recent survey from Optimum shows that there is a growing interest among would-be investors to get involved with alternative assets, but for the reasons previously mentioned, some are hesitant.

The advent of digital platforms empowering people to own stakes in art, wine, farmland, and other alternatives spurred a flurry of interest from those who took the time to learn about them. Given that, the poll found that 80% of respondents were unaware of or unfamiliar with these opportunities.

Conversely, when already active investors were asked similar questions, they answered with excitement. According to the survey’s results, these individuals would be willing to allocate 25% of their existing portfolio, or approximately $1.3 trillion. Suddenly, Preqin’s forecasts don’t seem too far-fetched.

But what about the four out of five respondents who were either skeptical or misinformed? The best path forward may be for them to have a better understanding of this exciting asset class before it reaches critical mass.

Maybe the biggest barrier of all is fear of the unknown. Thankfully, there are trained and trusted Family Wealth Advisors who can help educate clients and, with the Bellwether structure in place, alleviate the downsides of alternatives through repeatable, provable techniques and the expertise that comes with decades of industry experience. Book a meeting with a Bellwether Financial Wealth Advisor today.

Next Previous