“Home ownership is the cornerstone of a strong community.” – Rick Renzi

According to a poll conducted by Mustel Group and Sotheby’s International Realty Canada, one in three Canadian Generation Z adults plans to purchase their first home at some point in the next five years, and 67% of respondents expect personal savings to fund their homeownership dreams.

As one of Canada’s most financially self-aware demographics, reviewing their goals more frequently than any other cohort, the digital native generation will soon be able to add a new strategy to their toolkit: the First Home Savings Account (“FHSA”).

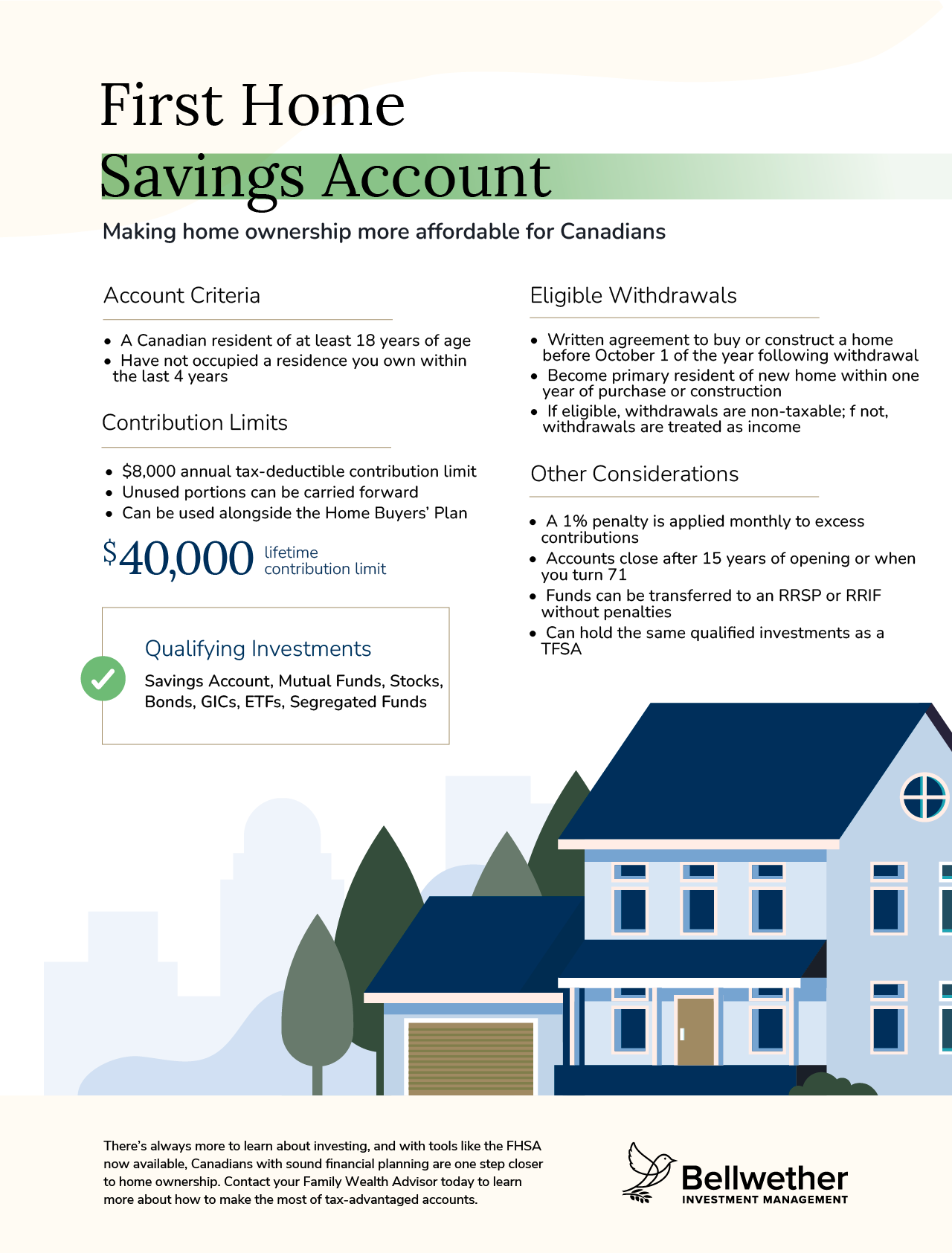

How Do I Open an FHSA?

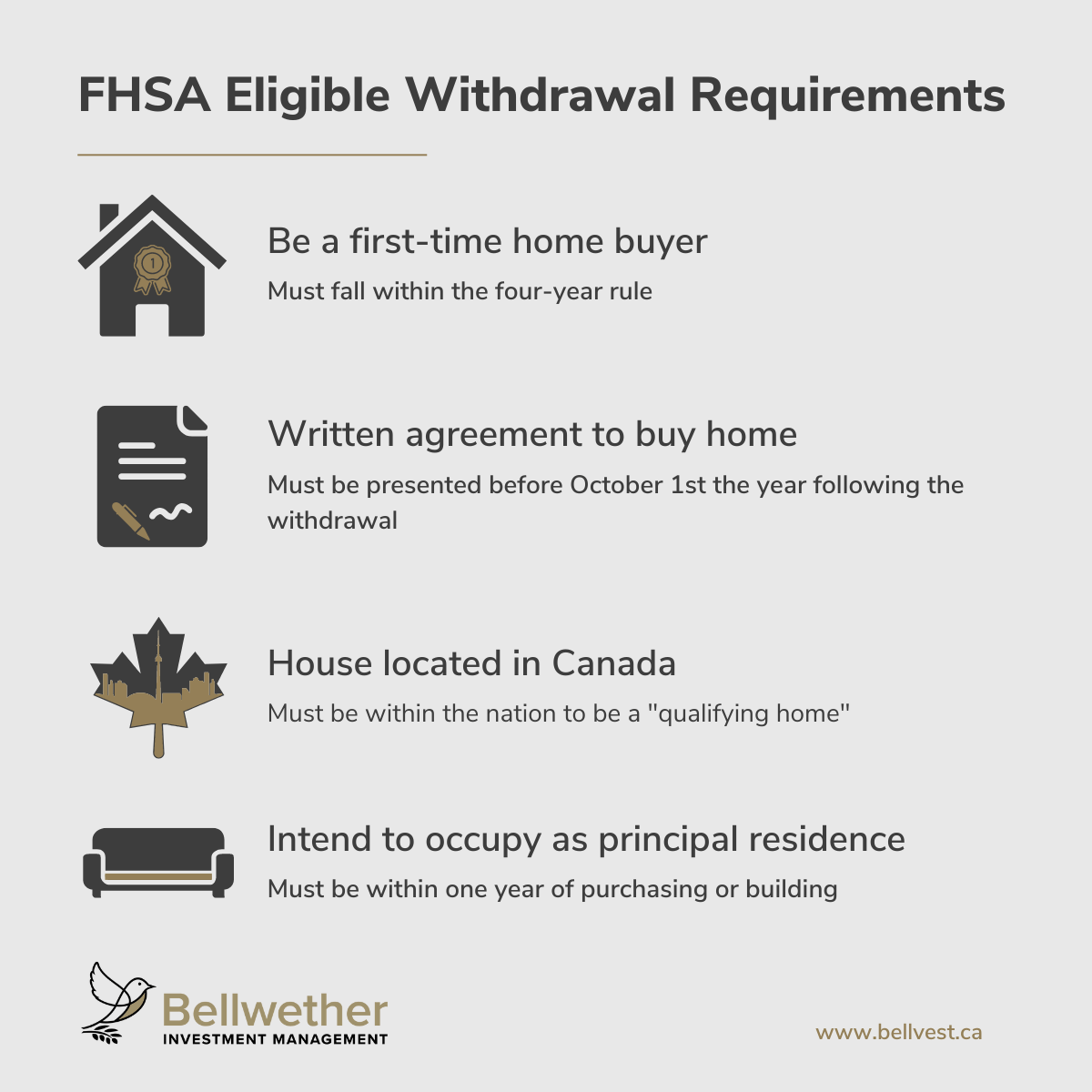

Your eligibility depends on a few factors. You must be a Canadian citizen of at least 18 years old and you (nor your partner) must not have owned a home that you lived in as your principal residence. This secondary requirement is time-gated, meaning ownership and residency rules are only enforced in the year that you open your account as well as the four years preceding it.

Any financial institution that can issue TFSAs or RRSPs is also able to do the same with FHSAs.

Your FHSA will be closed after the fifteenth anniversary of its inception or if you turn 71 years old, whichever occurs first. If this happens, you will be able to transfer your savings to an RRSP or RRIF on a tax-free basis. As an added benefit, funds transferred in this manner would “not reduce, or be limited by, an individual’s available RRSP contribution room” according to the Department of Finance.

How Does the FHSA Work?

First introduced in Budget 2022 to ease young adults along the path from leasing to owning, the FHSA is a tax-free savings account. The government has emphasized the tax benefits of the new account structure, pulling benefits from its more well-known cousins. Similar to an RRSP, contributions would be tax-deductible. Like a TFSA, withdrawals for the use of purchasing a first home (which includes investment income) are also non-taxable. In their own words, “tax-free in, tax-free out.”

How Much Can I Contribute to an FHSA?

Starting in April 2023, the annual contribution limit for eligible Canadian citizens will be $8,000, with a maximum of $40,000 over their lifetime. Although that may be out of reach for newly employed Canadians, any unused contribution room can be carried forward. In other words, if you put $4,000 into your FHSA in 2023, your limit for 2024 would be $12,000.

The carry-over clause can be used strategically. By opening an FHSA as soon as possible and putting a small sum towards it, you can start collecting contribution room each year. A caveat to this tactic is that the maximum amount that can be carried over is $8,000, so plan accordingly.

What Can I Invest In with an FHSA?

As our previous article explained, these savings programs are not products themselves, but rather just accounts with beneficial tax structures. Like a TFSA or RRSP, you can hold a broad range of qualified investments within the account to generate income—mutual funds, publicly traded securities, and bonds are all par for the course. As an investment vehicle, your FHSA can be an effective resource to grow your wealth if you have the proper guidance from a Family Wealth Advisor.

How Do I Withdraw from an FHSA?

There are a few requirements to make qualified (non-taxable) withdrawals:

Once these requirements are satisfied, withdrawals can be made at the account holder’s discretion with few limitations.

Any non-qualifying withdrawals would be categorized as income and taxed accordingly, so be careful not to hinder your investments or savings.

Is There More?

There is. Transferring between accounts, Home Buyers’ Plan interactions, advantage taxes, savings schedules, spousal contributions, attribution rules, marital breakdowns, collateralization, interest deductibility—the list goes on.

Decades of experience go into becoming a Family Wealth Advisor or Portfolio Manager, and with another new opportunity for investors to find financial freedom coming this April, there is always more to learn.

If you want to learn together and work towards affording your dream home, get started on the right track by working with a Bellwether Family Wealth Advisor.

Next Previous