Retirement is a blank sheet of paper. It is a chance to redesign your life into something new and different. ― Patrick Fowley

The numbers are in – according to a 2022 survey put forward by Advisorsavvy, over half of older Canadians who were planning their retirement have had to delay it due to mounting inflationary pressures. While this may come as no surprise, it begs the question: what are some financial mistakes you can avoid during your retirement?

1) Canadian Retirement: Plan Early, Plan Long

The difference between a good financial plan and a great one often comes down to time horizons. Contrary to popular belief, retirement starts well before that final day in the office and lasts well afterwards too: it is a whole stage of life, and your investment decisions should reflect that.

According to Bob Sewell, the president and CEO of Bellwether Investment Management, having a suitable, well-integrated investment policy can be a key component to your financial freedom. Diligent portfolio management is a cornerstone to success and having a wide array of fixed income options (such as preferred stocks and alternative assets) alongside equity investments can act as a hedge against inflation. If you’re not mindful of protecting against climbing inflation, the decades following your retirement could severely damage your spending power. Strategic asset mixes (i.e., the right blend of equities and fixed income) can help offset that reality.

2) Maintain and Gain Investment Capital

While your advisor manages your investments, you should manage your spending. To make up for the loss of your employment income, creating a monthly budget can reduce the risk of running out of capital too soon into your retirement.

The Charles Schwab Corporation has released an article explaining the 4% rule, and Sewell seems to agree. He argues that “anything more than 4% likely means you are spending some of your investment capital,” before acknowledging that his clients may “need [that] for the many years ahead.”

There are a handful of maneuvers you can make to optimize withdrawals from an account, which primarily boils down to when, where, and how you do so. Depending on your situation and the way your investment accounts are set up, you may be losing out on more than you know. Shuffling between accounts can be costly if you’re unsure of how to do so efficiently.

3) What's Worked So Far?

It’s probably safe to assume you worked hard to get here, and hopefully your financial advisor has as well. Different choices along the way – such as minimizing taxes, adjusting your asset mix based on current circumstances, and creating a comprehensive retirement and estate plan – may seem tedious, but the culmination of these methodological decisions is what makes up the bulk of your wealth. Making it to retirement is one thing, but staying there is a different battle altogether. Maintaining your financial plan year to year is paramount to experiencing comfort once you hang up your career, and now is not the time to change what has been effective up until this point.

4) Avoid Taking on New Debts

This one may seem obvious, but it should still be addressed. Do not take on new debts. By the time you reach retirement you should have already settled them. While everyone is under different circumstances and you may already have open lines of credit, what is ultimately more important is not incurring new ones.

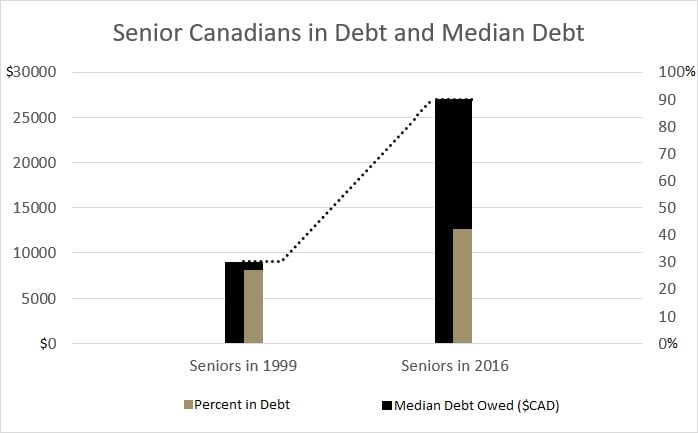

In a study published by Statistics Canada that investigated senior families and their finances, there has been a startling pattern beginning to emerge. Between 1999 and 2016, the rate of indebted families rose drastically from 27% to 42%. Worse yet, the median amount owed went from $9,000 to $25,000. A Bellwether Family Wealth Advisor can help you stay out of that category.

5) Family Wealth Professionals Are a Call Away

Although many individuals have done well in taking care of their finances personally, there may come a point in their lives where they no longer have the desire to do so. In other cases, situations may arise where the surviving spouse isn’t familiar with the complex details of their portfolio which can lead to undue stress for their financial (and emotional) well-being.

Thankfully, you do not have to go through this alone – from wealth management to estate planning, Bellwether is here to ease you along that path well before either of them becomes an issue. Retirement should not be a time for stress. It should be a time for family, enjoyment, and thanking yourself for the investments you made along the way. If you want to make them together, contact us today for a free portfolio review and consultation.

Next Previous