"The great aim of education is not knowledge but action." — Herbert Spencer

A Registered Education Savings Plan (RESP) allows individuals to contribute to a trusteed plan to finance the cost of post-secondary studies for a child, grandchild, or even themselves.

In this blog, we will explore why Canadians should consider registering for an RESP, as well as what factors can help plan for your family's future financial security.

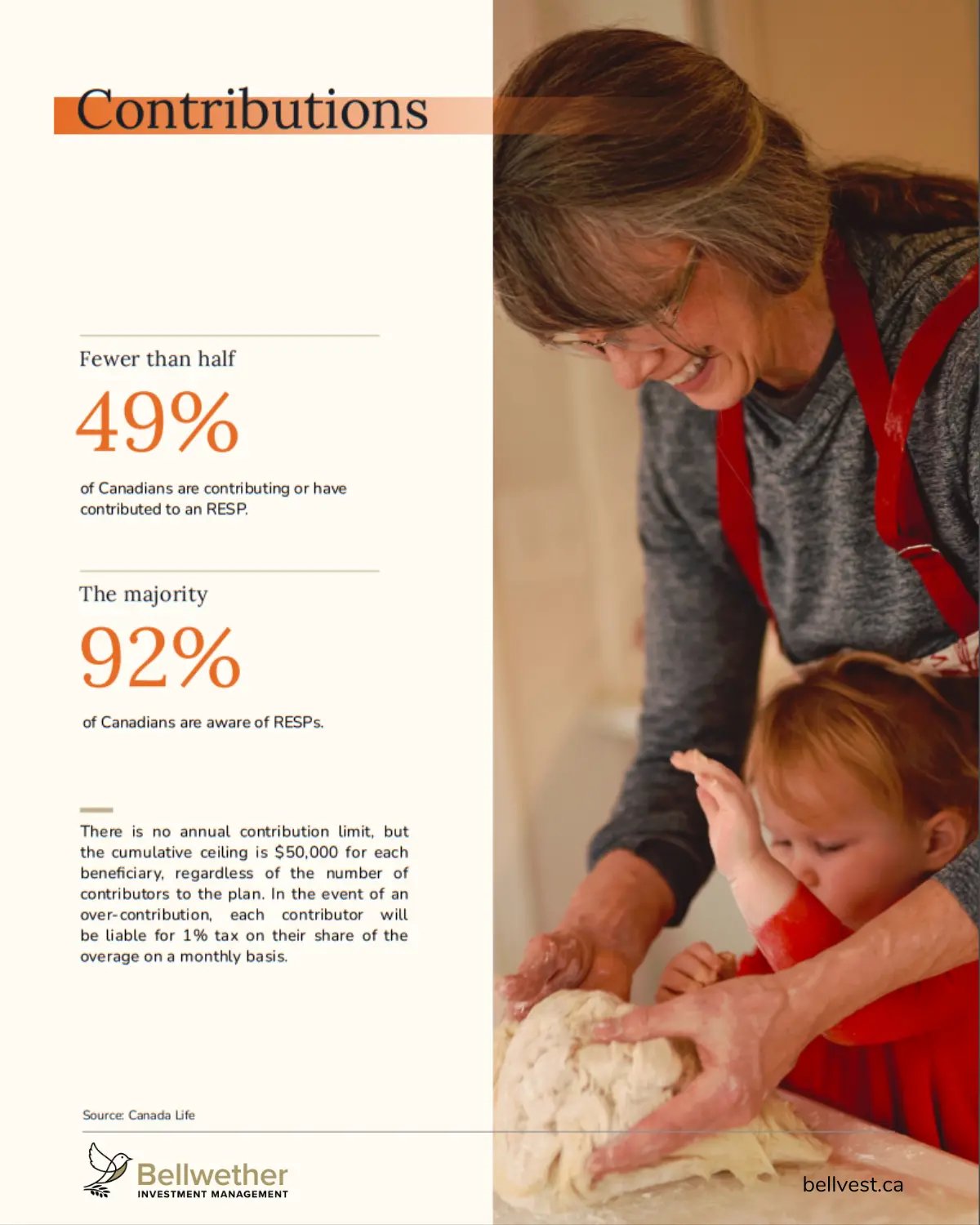

How Do RESP Contributions Work?

Although contributions are not tax-deductible, investment returns accumulate in the plan tax-free and can be paid to a student as an Education Assistance Payment (EAP). Thankfully, most students have little to no income, meaning that many can withdraw on a tax-free basis during their education. But even with these benefits in place, Canadians don't seem to be taking advantage of the opportunities available to them.

An RESP, which has a maximum life of 35 years, is typically a family or non-family plan. Most family plans allow for the addition of related beneficiaries throughout the term of the plan, while non-family plans are not subject to this requirement.

What's the Canada Education Savings Grant?

Through the Employment and Social Development Canada (ESDC) initiative, the federal government incentivizes parents, family, and friends to help children pursue higher education by paying a grant determined by contributions made to an RESP.

The ultimate goal of the Canada Education Savings Grant (CESG) program is to encourage long-term savings intended for post-secondary education, and as such, beneficiaries who are 16 or 17 years of age have specific requirements in order to be eligible. Namely, one of the following conditions must be fulfilled:

- The RESP must have a minimum of $2,000 contributed to (and not withdrawn from) before the end of the calendar year of the child turning 15 years old.

- At minimum, an annual contribution of $100 was made to (and not withdrawn from) the RESP four years or fewer—prior to the end of the calendar year of the child turning 15 years old.

The maximum annual CESG per beneficiary is $500, or 20% of the first $2,500 of contributions calculated annually. Each child is entitled to a cumulative maximum CESG of $7,200. Additional CESG may be available for low- to middle-income households earning an adjusted family income of $111,733 or less.

A plan that has not been contributed to for a year or more and therefore has unused contribution room for future years can receive a CESG of not more than $1,000 in a calendar year—for example, the CESG on a maximum contribution of $5,000.

What's the Canada Learning Bond (CLB)?

Low-income families with children born in 2004 or later may be eligible for a CLB, which provides an initial payment of $500 and an additional $100 for each year of eligibility—in other words, $2,000 is the maximum possible allotment through the program. The period ends once the child is 15 years of age or if household income surpasses a certain threshold.

The ESDC will deposit $25 into the account in an effort to help defray the cost of opening an RESP, and the CLB will deposit $500 after that. In theory, this should help families who are discouraged by the one-time expense of opening an account.

| Number of Children | Adjusted Income Level |

| 1 to 3 | Less than or equal to $55,867 |

| 4 | Less than $63,036 |

| 5 | Less than $70,234 |

Table 1: Adjusted Family Income & Eligibility for the CLB

It’s worthwhile to note that personal contributions are not necessary for children to receive CLB benefits.

What are Educational Assistance Payments (EAPs)?

Education Assistance Payments are distributions of non-contribution amounts accumulated in the RESP. To be entitled to receive payments, a beneficiary must be registered in a qualifying post-secondary program. An $8,000 limit applies to Educational Assistance Payments paid to full-time students during the first 13 consecutive weeks of an eligible program, following which there is no limit on withdrawals as long as the child continues to be registered in a qualifying program. Part-time students who take at least 12 hours of courses per month can generally receive Educational Assistance Payments up to $4,000 per semester. RESP beneficiaries can receive payments from the plan up to six months following the termination of their registration in a qualifying program.

Payments are included in the student’s income the year they are made.

A beneficiary can also receive payments that represent the accumulated capital contributed to the plan. The receipt of capital payments is not taxable.

What are Reimbursements of Government Assistance?

If none of the beneficiaries of a family plan or beneficiaries of an individual plan pursue post-secondary studies within 36 years of opening the account, the amount of CESG must be reimbursed to the government.

Additionally, RESP withdrawals that are not explicitly used for education related reasons are not taxed. As a word of caution, the interest earned (called accumulated income) will be taxed at your marginal rate plus an additional 20% penalty, but withdrawals against the capital contributions are not subject to this rule.

Can RESPs be Transferred?

Under certain circumstances, individuals may consider withdrawing the principal contributions and income generated by the plan. Depending on the scenario, there are certain ways to reduce the payable taxes by transferring the accumulated income payments to tax-advantaged accounts. We recommend consulting with an accountant or a Family Wealth Manager to learn more about your situation and next steps.

Are RESPs Right for Me?

Although secondary education isn’t for everyone, the important takeaway is that the RESP should be seen as a tool to provide children with as many options as possible for their future.

Planning ahead can be difficult, but if it means the next generation will be better equipped to find their calling in life, it’s worth it. This is a surface-level overview of just one of the many resources at your disposal to help your loved ones get ahead. There are countless nuances to consider, and if you have any questions, we’re here to answer them.

Next Previous